| Related Links: | Articles on arts |

| Letters Menu | Archival Menu |

The Bank has taken a decision which I believe could have a demoralising effect on other workers - imagine being fired for the actions of a co-worker which you know nothing about? I would expect if the Bank's workers were unionised there would be a backlash against such a policy. A former employee indicated to me that following the takeover by Republic Bank of Trinidad, union activity was not encouraged, despite the parent company in Trinidad being unionised! Without a collective body I think that the Bank's policy, however justified from the standpoint of protecting depositor's funds, may lead to distrust among co-workers and perhaps even a climate of paranoia. Given that, as a service provider, one of the bank's main assets is its human resource personnel it remains to be seen whether the incident will have any long-term impact on the morale of staff and hence the service they are providing.

I wonder how many of those critical of the bank's decision are depositors and/or shareholders and would think of closing their account and moving it elsewhere or selling their shares, in protest. I suspect not many, so the short term impact of fraud would be negligible. In answer to one letter writer's comments regarding disclosure of the theft, the impact is likely to be included in the non-interest expenses, and amounted to just 1.2% of the G$670M expenses for the quarter, and 2.2% of the net profit for the period which I would not view as significant enough to warrant a separate disclosure.

Republic Bank (Guyana) Ltd's Performance

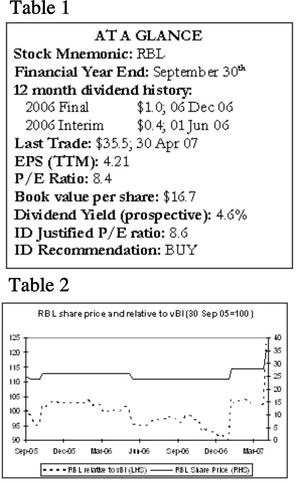

Last week, one trade involving 2500 shares traded in RBL on the local stock exchange - at a 26% increase over the previous close. Clearly, despite the ATM incident demand remains strong for the stock and investors believe that the bank made the correct decision.

(See Table 2)

This is not surprising given that the bank continues to perform exceptionally. Consistent with the quarterly results issued for the first time in January, the bank not only shows the half-year figures required by the regulations but also the results for the most recent quarter - which shows net profit for the quarter of G$386 million, compared with G$254 for the equivalent 3 month period one year ago.

The Bank continues to attract deposits and invests them to earn a healthy spread with both investments and loans and advances increasing by 12% and 17% respectively. A significant contribution to the bottom line is the recovery of loans previously written off, which now exceeds the provision for non-performing loans by such an extent that the net amount in the Profit and Loss is actually a credit to the tune of $166 million. It should be noted that this is a volatile source of earnings and may not be expected to recur.

Financial Highlights (See table 3)

In a dramatic turnaround in accounting policy the bank is once more building up its General Banking risk reserve "the RBL Group's internal policy on provisioning stipulates a mandatory 100% coverage of the total non-performing loans. Any difference between this provision and the impairment provision determined under International Financial Reporting Standards is apportioned out of Retained Earnings to the General Banking Risk Reserve in accordance with the Bank's accounting Policy". In a previous analysis I had indicated that RBL's provision as a percentage of non-performing loans was low. While the extra reserve will build up additional resources in the event non-performing loans need to be written of, it will also serve as a drag on return-on-equity as the reserve is considered as part of shareholder's funds. At the current rate of return on equity this is not a problem, however if the return of equity falls the funds may be better returned to the shareholders by way of dividends.

Justified PE & Investor's Diary recommendation

I have been using a growth rate of 10% when determining an appropriate price for RBL's shares, and each analysis has seen this comfortably surpassed. Yet I do not believe that earnings can continue to grow at levels recently seen, unless there is a paradigm shift in the economy. Thus I will stick with my 10% expected earnings growth rate which along with a required rate of return of 15% justifies a price earnings ratio of 8.6; equivalent to a share price of G$36.3.

(See Table 4)

This just pips the last trade of $35.5 so at current valuations this stock is still a buy recommendation, though I would not recommend paying much more than this unless you believe earnings will be significantly greater than 10%.

This writer has an interest in RBL by virtue of the writer and/or an associate being a shareholder.

Disclaimer: All information contained in this article has been obtained from sources that the writer believes to be accurate and reliable. All opinions and estimates constitute the Author's judgement as of the date of the article; however neither its accuracy and completeness nor the opinions based thereon are guaranteed. As such, no warranty, express or implied, as to the accuracy, timeliness or completeness of this article is given or made by the writer or this newspaper in any form whatsoever. The writer and/or its associates may, where applicable effect transactions, or have positions in securities or companies mentioned herein. Neither the information nor any opinion expressed shall be construed to be or constitute an offer or a solicitation to buy or sell.