| Related Links: | Articles on stock exchange |

| Letters Menu | Archival Menu |

Introduction

While I was writing for Stabroek Business I made an effort to provide regular updates on our fledgling stock market and compare its performance with exchanges within the region and worldwide. Given that the last trading days for this year passed on Friday I think it is appropriate to look back on the performance of the regional markets, particularly as I made a prediction for 2006 about the level of the local market! 2005 was a very eventful year with large swings in several of the Caribbean markets - Guyana and the ECSE up, while Jamaica and Trinidad and Tobago were down. I felt that 2006 was unlikely to return the same levels as 2005. Having been proved wrong when I made this prediction at the end of 2004 (in respect of 2005) it is somewhat comforting to see that my predications are now no less bad than would be expected by flipping a coin! Guyana's market witnessed very modest growth for 2006, with the value of my index (the van Beek Index - or vBI for short) increasing by just 1.4% over its 2005 closing figure compared with a 36.8% increase over 2005.

A Company finally lists on Guyana's Exchange

Given all the rhetoric by public companies about their adherence to corporate governance, it is perhaps surprising that not one company in Guyana opted to become subject to the scrutiny of the local stock exchange - while worldwide the benchmark for good governance for publicly owned companies is to be listed at the local stock exchange. Sources at the local stock exchange operated by GASCI have indicated that a regional company has recently sought approval and been accepted to the official list - the first company on our local exchange to do so. One can only surmise what image it portrays to the rest of the region when the only company listed in Guyana is not even Guyanese! I have witnessed first hand the manner in which Guyanese are treated in some of areas of the region (the bench at immigration in Barbados being perhaps the most infamous). How can Guyana project a positive image if our public companies cannot raise themselves to the same level of standards practiced by the rest of the region?

In Guyana I feel that some CEOs would rather pretend the stock exchange does not exist. Though a stock market provides the most transparent form of price discovery if the prices being discovered are not to the liking of the company in question at best the market is ignored. In one case, attacks were made on the price discovery mechanism arguing market manipulation was taking place based on unfilled positions. In any developed market such arguments would be laughed at - to put such an argument into context it is the equivalent of saying that if I walk into Boarda market and say that I am prepared to buy plantain at G$10 per pound I am manipulating the price of plantains - never mind that no one is obligated to sell to me at that price. Unfortunately in a developing market such attacks merely serve to spread distrust and misunderstanding of how the market is intended to work.

Ignoring the market has allowed other absurdities to have arisen - last year Caribbean Containers Inc. saw stock on offer with no takers. The price was gradually reduced until it hit 20 cents per share - at which point a trade was finally struck. The following week the price increases tenfold. One can only surmise that those with an interest in the stock realised the absurdity of a 20 cent share price and placed bids to improve the price. I can imagine though that if no trade had been struck the best offer would still be on the board at G$0.2. Such situations suggest that those making policy decisions about the course a company are generally reacting to events in the marketplace, rather than taking proactive steps to prevent them happening in the first place. As a student I often wondered why penny stocks were viewed with such stigma - I figured that as long as a company is turning a profit then it should be able to make a recovery. The hard fact is that in many cases although the company may be eking out a profit there may be major problems which are priced into the share price such as lack of cash flow or the imminent loss of a major source of income. The morale of the story is to ignore the market at your peril - the market is not often wrong,

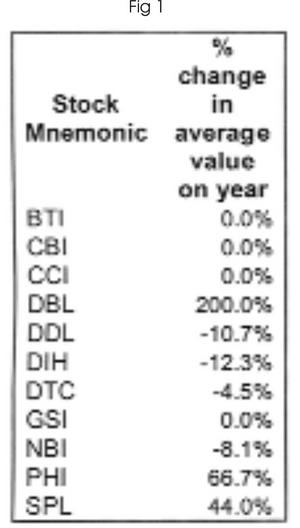

2006 local market performance (See Fig 1)

The rather modest growth in the market as a whole may come as a surprise given that individual stocks saw large price movements over the year - only in aggregate do these cancel out.

DBL saw a threefold increase in price going from G$3 to G$9 over the year. DBL moved up in two jumps - the first was demand driven, when bids were placed at around G$5 which enticed sellers to part with their stock - the second jump was down to the supply side. There being no stock on offer at any price an entrepreneurial seller decided to see how much people were willing to pay. DBL is an extremely illiquid stock and clearly investors were willing to pay a premium to get hold of some of the shares as the next week a trade was struck - at G$9 it is trading at 14 times earnings - almost double the average of its peers. Interestingly there is now support at near that price so for the time being I would expect to see that if DBL does trade it will be close to that price.

The other large movements came in PHI and SPL, and similar to those in DBL were driven by lack of liquidity with a handful of buyers prepared to pay the price on offer. It should be noted that both these stocks have large spreads and such increases can easily be reversed given there are no buyers standing ready to buy at prices currently being paid. If a forced seller comes to the market the price will fall.

Regional market performance

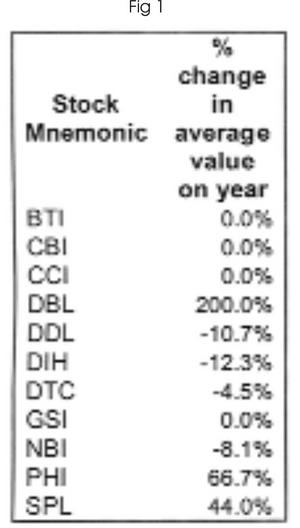

% change in local market indexes for regional stock exchanges (See Fig 2)

A look at the major markets of the Caribbean sees a common pattern across the region - all these markets saw their local market indices fall at some point over the year (the local market index excludes cross listed companies). Of the four, until October the Barbados Stock Exchange (BSE) was best performing market - but by year end both Guyana (vBI) and Jamaica (JSE) had recovered to close higher than Barbados.

Jamaica saw extreme volatility - at one point down over 20%, before ending the year down just under 4%. The Trinidad & Tobago stock exchange (TTSE) saw the worst performance for the year; despite staging something of a come back the market still closed down nearly 10% on the year. Note that data for the BSE and TTSE graphs above are monthly as more frequent data is not readily available from their markets hence apparent lack of volatility compared with the JSE and the vBI.

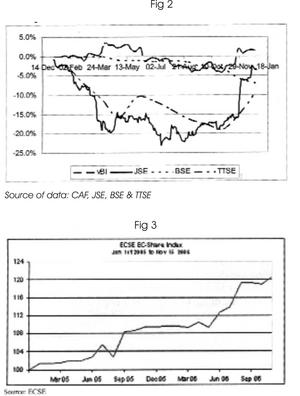

The best performing market of the Caribbean for 2006 and the outlook for 2007

The best performing market of the Caribbean for 2006 was none of these four though - the Eastern Caribbean Stock Exchange (ECSE) had the strongest showing, up around 10% for the year. Unfortunately the ECSE does not publish index values on their website, so I could not include them on my graph hence the performance is shown separately in the graph below. (See Fig 3)

For 2007 I am still quite bullish on Guyana given its price earnings multiples are the lowest in the region, and the continuing strong performance of the banking sector. The impact of the Cricket World Cup next year is difficult to call; I would expect it to be largely beneficial to most companies in the region in the short term though there is considerable uncertainty on the longer term macro economic impact as the cost of hosting the event feeds through to the public coffers.

If asked to pick the best and worst performing markets in the region for 2007 I would put Guyana on top and Trinidad and Tobago on the bottom. Tune in next year to see how this year's predictions turn out!