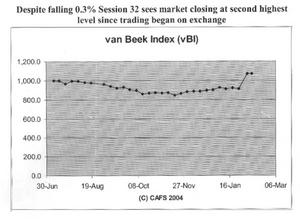

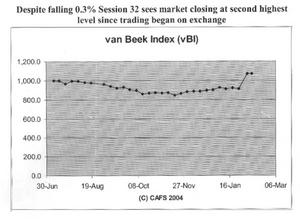

Despite falling 0.3% market closes at second highest level since trading began on exchange

Stock market update

Stabroek News

February 12, 2004

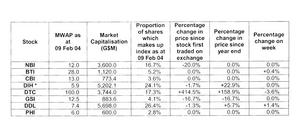

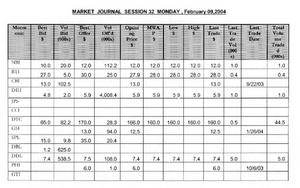

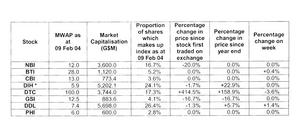

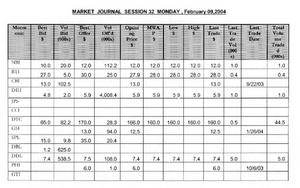

February 9 trading session saw the largest value of shares traded this year and the second largest session by value to date. DIH held steady at $5.9, remaining ahead of the theoretical ex-bonus price on the close of session 30 of $5.0. DTC backed off $6 per share or 3.6% to close at $160 as orders to sell some 44.5 thousand shares were routed onto the exchange and filled at this price. The session saw the average price of DDL and BTI up 1 tick or 1.4% and 0.4% respectively. Trading continues in NBI, though the price has remained unchanged at $12. The falls just outweighed the gains and the market closed down with the index giving up 2.9 points or 0.27% to close at 1067, the second highest level since trading began on the exchange.

* adjusted assuming proposed bonus issue is approved

The market information provided here is provided for informational and educational purposes only and is provided on a time delayed basis. Caribbean Actuarial & Financial Services does not guarantee the accuracy or completeness of any information contained on this page. Although the information has been obtained by Caribbean Actuarial & Financial Services from sources believed to be reliable, it is provided on an "as is" basis without warranties of any kind. Caribbean Actuarial & Financial Services assumes no responsibility for the consequences of any errors or omissions. Caribbean Actuarial & Financial Services does not make or has not made any recommendation regarding any of the securities issued by any of the companies identified here nor the advisability of investing in securities generally for any particular individual.

Demerara Tobacco Company (DTC), which share price climbed from $65 to $166 last week (with just 2500 shares traded), again dominated trading this week. This time, 44,457 shares or 85.8 % of a total of 51,807 shares traded were those of DTC, changing hands at a slightly reduced price of $160. In effect, 99.3 % of the total consideration of $7,177,820 involved shares from DTC. Whilst this week's share volume traded has been significantly reduced, the consideration increased 13.3 % over the previous week value of $6,336,732.

Shares were also traded for four (4) other registered issuers, namely Banks DIH Ltd (DIH), Demerara Distillers Limited (DDL), Guyana Bank for Trade and Industry (BTI) and National Bank of Industry & Commerce (NBI). DDL followed DTC with 5,000 shares traded at a Mean Weighted Average Price (MWAP) of $7.40 which is 1.4 % higher when compared to the previous week.

For DIH, 1,000 shares with the price remaining at $5.9 were traded while 1000 shares of NBI changed hands at a steady MWAP of $12.0.

Compared to last week when 73,800 shares from BTI exchanged hands at a Mean Weighted Average Price (MWAP) of $27.9, only 350 shares were traded for $28.0 each representing a 0.4% increase in MWAP.

Trading on the stock exchange continues next Monday at 10 AM at the offices of GASCI located on the corner of Avenue of the Republic and Robb Street.

Despite falling 0.3% market closes at second highest level since trading began on exchange GASCI S

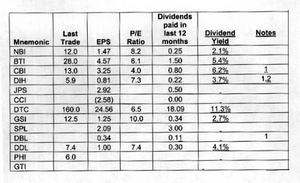

Notes

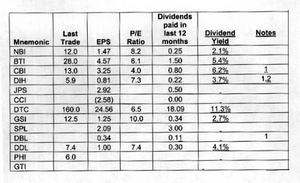

1 - Dividend figures are prospective and assume final dividend is approved at annual general meetings.

2 - Figures have not been adjusted for proposed bonus issue.

EPS: earnings per share for a 12 month period to the date the latest financials have been prepared (2003 year end for NBI, DBL and DIH; 2002 for CCI and the 2003 interim results for the remainder). As such the majority of these EPS calculations are based on un-audited figures.

P/E Ratio: Price Earnings Ratio = Last trade price / EPS

Dividend yield = dividends paid in the last 12 months/ last trade. The dividends paid in respect of the 12 month period immediately prior to the trading session.

The market information provided here is provided for informational and educational purposes only and is provided on a time delayed basis. GASCI does not guarantee the accuracy or completeness of any information contained on this page. Although the information has been obtained by GASCI from sources believed to be reliable, it is provided on an "as is" basis without warranties of any kind. GASCI assumes no responsibility for the consequences of any errors or omissions. GASCI does not make or has not made any recommendation regarding any of the securities issued by any of the companies identified here nor the advisability of investing in securities generally for any particular individual.

Financial markets first came to prominence during the 17th century at the start of the Industrial Revolution. Businesses needed vast amounts of capital to buy larger premises and new machinery.

At the time of the Industrial Revolution, there were few investors capable of supporting businesses on the vast scale required. The financial markets arose as a result of several small investors joining forces to present a unified approach towards major investments in industries.

The first financial markets came about in Europe, to fund both the industrial revolution and the expansion of the British Empire. As the need for financial trading grew, so did the places of trading. In London for example a lot of early financial trading took place in tea houses, prior to the establishment of the London Stock Exchange.

In Guyana today, we have a Stock Exchange, which exists as a medium for processing financial transactions. The most common form of financial trading is done in the form of shares. Local businesses can generate extra investment capital by issuing shares onto the market, which can then be traded on the stock exchange. Investors in shares (called shareholders) can make money if they sell shares they hold for a higher value than what they purchased those shares for. Shareholders are also entitled to a share in the profits of businesses, which are paid out in the form of dividends. Shareholders also get to vote at annual general meetings.

The Guyana Association of Securities Companies and Intermediaries, GASCI is a private company, owned by its members, who are the stockbrokers who compete against each other in share trading.

Despite falling 0.3% market closes at second highest level since trading began on exchange Did you

Financial markets first came to prominence during the 17th century at the start of the Industrial Revolution. Businesses needed vast amounts of capital to buy larger premises and new machinery.

At the time of the Industrial Revolution, there were few investors capable of supporting businesses on the vast scale required. The financial markets arose as a result of several small investors joining forces to present a unified approach towards major investments in industries.

The first financial markets came about in Europe, to fund both the industrial revolution and the expansion of the British Empire. As the need for financial trading grew, so did the places of trading. In London for example a lot of early financial trading took place in tea houses, prior to the establishment of the London Stock Exchange.

In Guyana today, we have a Stock Exchange, which exists as a medium for processing financial transactions. The most common form of financial trading is done in the form of shares. Local businesses can generate extra investment capital by issuing shares onto the market, which can then be traded on the stock exchange. Investors in shares (called shareholders) can make money if they sell shares they hold for a higher value than what they purchased those shares for. Shareholders are also entitled to a share in the profits of businesses, which are paid out in the form of dividends. Shareholders also get to vote at annual general meetings.

The Guyana Association of Securities Companies and Intermediaries, GASCI is a private company, owned by its members, who are the stockbrokers who compete against each other in share trading.