Receiver/managers had been appointed for both of these companies among

others, which in the last few years went bankrupt, and NBIC, under the

direction of its new managing director, has begun taking a second and a very

pro-business look at its bad-debt portfolio. This stood at $3.7B last year

or 29% of its loan portfolio.

“We are prepared to sit with any of our customers who have had difficulties

and talk about ways and means of restructuring and reorganizing their loan

portfolios,” Michael Archibald, NBIC’s new managing director, told Stabroek

Business. But he said people should not confront the bank with a request for

more time, but rather with a tangible proposal on how they intend to

restructure their operations.

While Archibald would not discuss the specifics of any of the cases of

restructuring before the bank, including the two mentioned above, he says

NBIC is working with more than half of its clients in receivership to

restructure their debts but seems to be enjoying more successes now.

Reports reaching this newspaper indicated that since Archibald took over the

helm, owner of the Guyana Furniture Manufacturing Company, Mohabir Singh,

was able to retake control of his firm and is running it, as opposed to the

arrangement under receivership where Barama Company Limited was put in

charge. In the arrangement arrived at with the bank, Stabroek Business was

told that a hefty portion of the interest accruing on Singh’s portfolio was

written off and the principal was restructured to allow him to service his

debt. A similar arrangement is being worked out with Sankar in conjunction

with his other creditors, the Commonwealth Development Corporation (CDC) and

the Guyana Bank for Trade and Industry Limited (GBTI).

The new approach by NBIC comes after a number of its clients went bankrupt

over the years and the bank had been accused of being hostile to businesses

in the stringent measures it had adopted. Addition-ally, the depressed

nature of the economy as well as the property market did not allow the bank

to recover its outstanding debt in the receiver/manager arrangements it

undertook.

But Archibald defends the route NBIC took in the past, saying that calling

in the debentures had to be done to drive home to clients the gravity of the

situation they faced if they did not make crucial changes to restructure

their operations. He explained that while some companies were willing to

change the way they did business and even undergo lifestyle changes, some

had difficulty going this route.

“Many people had to see action being taken before they became willing to

make the necessary changes. After it registered that someone else is in the

chair, then these companies came around to the position that it will be

better to sit and talk....of course after they called us all sorts of

names,” Archibald says, a position endorsed by head of credit, John Alves.

Archibald insists that it is not a shift in policy for NBIC to take another

look at the none-performing loans after it moved in on clients. He says the

bank has always been flexible in its approach to dealing with clients,

especially in light of a legal system fraught with delays. But he notes that

the Financial Institutions Act of 1995 has very specific requirements as it

relates to loan classifications and this forced the bank’s hands in the last

few years. And being the biggest bank, it meant that more customers were

affected. He says NBIC has tried to work with most of its clients to

restructure their debts and while some have worked along with the bank “very

willingly, others have not”. He said even in cases where persons were taken

to court, the bank is still willing to sit with these customers and find

ways to restructure their portfolio as it is not in the bank’s interest to

have these issues dragged out in the judicial system. For NBIC, he says,

appointing a receiver/manager is a measure of last resort.

“People have to be prepared to make changes in the way they do business, to

make lifestyle changes and some individual changes,” says Archibald.

He recognizes, however, that much animosity has built up in the relationship

between top management and clients in the last few years and having someone

new in place (himself) to talk to will help to lessen this animosity.

Alves echoed the view that it had to sink in to businessmen that their

businesses were going down and they were losing all that they had worked for

before they took stock and took the hard decisions necessary to keep their

businesses afloat.

Interest rates is an excuse

Archibald believes the interest rates on loans were used as an excuse by

businesses for their failures and sees poor management as the main reason

for these failures in the face of depressed market conditions.

“People did not make the management changes which were required. In my view,

businesses just continued as normal and did not respond to the changes

around them; to the need to tighten their belt; to the need to adjust, and

went along their merry way as they did in the past,” Archibald asserts.

A lot of the management, production and technological practices of the

businesses dated back as old as 20 years and Archibald underscores the need

for firms to keep abreast at all times with what is taking place in the

market place.

Both Archibald and Alves noted that the inability to recover monies lent out

and the abuse of the judicial system in the recovery process had increased

the risk of intermediation and the cost of funds by virtue of the

provisioning process where the bank has to forego income and then this

appeared as a charge on its accounts. This did not help the process of

lowering the lending rates and credit to the private sector has also fallen,

shrinking by $10 billion or 18.2% in the first half of this year. The prime

lending rate at NBIC is currently 17% and can go up to 21.5% depending on

the risks. But the Bank does engage in negotiations for clients that it has

to compete for. NBIC claims that its spread is in mid-single digits, but can

come further down once these problems are eradicated.

Both of the NBIC top men welcomed the establishment of a commercial court

and hope that the judges selected to preside will have commercial law

experience and would not be the very judges who have been granting stays of

execution and exparte injunctions blocking the enforcement of contract

processes. Alves notes that sometimes it took as much as three years to get

to trial and then after a trial, another judge would grant an 18-month stay

of execution against the judgment.

As a result of these realities, NBIC has been taking a more cautious

approach to lending and is focusing more now on one’s ability to repay and

one’s management practices to determine whether a loan should be granted, as

opposed to the heavy emphasis in the past on one’s assets. As a result,

Alves says fewer persons are qualifying for loans and fewer loans are being

advanced.

In 2002, loans to the agriculture sector by NBIC fell by 30%, while loans to

the manufacturing sector fell by 31% and this situation continued for the

2003 fiscal year. The bank’s financial performance this year, however, is

said to be much better than the $128M after-tax profit in 2002.

The sectors in which the bank has noted notable increases in lending in the

2003 fiscal year were the personal sector and the residential mortgages

sector.

The bank sees the mortgage sector as the one holding the most potential for

growth once the government can find a way to expedite the processing of

transport deeds.

New schemes are being created under the title system but a number of old

schemes, still under construction, were done under the old transport system.

Alves also underscores the need for basic infrastructure to be put in place

in these schemes to encourage construction.

“Banks do have money to lend out and we want to lend, but persons need title

before we can lend.” Alves said. Pushing housing development faster will not

only redound to NBIC’s benefit, but to the entire economy’s because of the

ripple effect of the construction sector.

NBIC is the single largest bank, locally, with assets of $52 billion, up

from $34B in 2002. Its deposits have increased to $45B and it now has some

150 000 depositors. (Back to top)

Dollar hits

$200/US$1

The G$/US$ exchange rate has hit the G$200/US$1 at most street and

cambio dealers. Swiss House Cambio yesterday confirmed it has been selling

the US$ at $200 for almost two weeks now but indicated that most of the

banks were quoting $204 to customers. The lead cambio expects, that with the

onset of Christmas, rates will fall back to the $196/$1 level. For months,

persons have been forecasting that the Guyana dollar will cross the

psychological barrier to reach G$200/US$1.

(Back to top)

Political

stability key for private sector growth

- deGroot

Dr Peter deGroot was returned as Chairman of the Private Sector

Commission (PSC) last week and sees the main goal of the PSC in this term as

the lobby for a stable political environment, which will include work to

ensure that the electoral machinery for the 2006 General Elections is

well-oiled and there is no potential for political turmoil.

“The most important issue and challenge facing the private sector is the

maintenance of a stable political environment. The lack of this enabling

environment has led to and will continue to lead to increased levels of

crime; reduced levels of private sector activity; reduced investments and

increased loss of human resources through migration,” Dr deGroot says.

He notes that a stable political environment has eluded the country in

recent times and though the situation had improved recently, “it is now far

from ideal”. He adds that the private sector is in a ‘wait and see’ mode

regarding their investments, but notes that time is not on Guyana’s side and

there is urgent need for an enabling environment for businesses to make

money, to create jobs and as a result, realise lower poverty rates.

“We need to keep moving all the time and to develop from an organisation

which operates as one fighting fires to one that prevents fires,” says

deGroot, adding that this is what the PSC is aiming to achieve.

As to the crime situation, deGroot says he gets a sense that businessmen are

not convinced that the problem is over, but at the same time are not unduly

alarmed by the sporadic incidence of killings or kidnappings.

But of concern, deGroot notes, is the alarming rate of the loss of scarce

skilled human capital through emigration, which seriously affects the

business community.

This emigration, he feels, is a result of the unstable environment, the

perception of the grass being greener on the outside, and developed

countries’ programmes actively soliciting such skills. For him, the major

hurdle to be crossed in pursuing a stable political environment, is keeping

alive the embryonic stakeholders briefing group, whose major objective is to

objectively assess progress in the implementation of the Joint Communiqué

between the government and the opposition.

As he sees it, there are no clearly established deadlines in the communiqué

and the lack of trust between the parties does not help the process. Hence,

he sees a crucial role to be played by this independent monitoring group to

push the process along.

“What I am hoping now is that we can move out of the mode of helping to

solve problems after they have occurred and to use our collective experience

and try to be more proactive - try to prevent the problems before they

occur,” says deGroot.

One such area of focus will be the general elections scheduled in two years.

“Although this is not an immediate issue, it is nevertheless a significant

challenge that we will have to face fairly soon. The history of political

unrest and social upheaval in the aftermath of general elections has a

significant negative impact on the business community,” says deGroot. He

notes the experiences of little or no investments in the year prior to

general elections and the problems of the post-election periods.

DeGroot says of concern is whether the Elections Commission will be ready

for General Elections in 2006 and why it is they are still unable to hold

regional elections after over two years.

He says no one in the PSC is aware of what the constraints are on the ground

as it relates to the electoral machinery process.

What the PSC intends to do is to work with the Elections Commission through

its governance and security sub-committee headed by retired major general,

Norman McLean, to determine the issues on the ground that needs ironing out

for a smooth running off of the local and general elections. This PSC

sub-committee was recently merged with the Guyana Manufacturers’ Association

sub-committee.

DeGroot notes that as of now, it is not clear under what system the next

elections will be held because the system of regional representatives plus

national representatives on an eligible list contesting the general

elections was only valid for the 2001 elections. He also notes the problem

of the list system where politicians are not accountable to the people but

rather to the head of the list.

The PSC’s governance sub-committee has begun looking at the issue of the

system under which the national elections are to be held with a view to

arriving at a PSC position. This position will then be used to help

influence the national position on what would be the best system for Guyana.

DeGroot stresses that the PSC will be a neutral member in the process to

ensure a timely, smooth and an efficient general election.

Among the other challenges facing the private sector and highlighted by

deGroot were the unstable and high cost of electricity, which cuts into the

ability of firms to be internationally competitive, as well as the high cost

of credit.

One of the successes, which the PSC has enjoyed, was the opportunity to

revisit the investment code/bill, which is now with a parliamentary select

committee. DeGroot says that through the process of constructive engagement

with the Government and consultation with the Opposition a mutually

acceptable document was arrived at and this process of reworking the bill

represents a perfect example of how the collective minds of the private

sector, the government and the opposition can work together for the benefit

of the country. (Back to top)

Badal

negotiating US$10M rice investment move to Trinidad

Guyana Stockfeeds Inc. (GSI) has received an offer to move its

proposed US$10 million parboiled rice mill to Trinidad and Chief Executive

Officer, Robert Badal, says he will insist that the board look at the offer

seriously.

Badal did not want to disclose the name of the company making the offer, but

says GSI will seek majority control (51%) in the joint-venture arrangement

on the cards.

“I am fed up with the unwarranted frustration (locally) and shall insist at

the next meeting of the board that it seriously considers this option to

take the investment to Trinidad, which enjoys a large local market and

excellent access to those in the Eastern Caribbean, as well as very cheap

electricity. I have definite assurances that all necessary permits, fiscal

concessions, shall be secured by the prospective Trinidadian joint- venture

partners. The company is now at a Rubicon between what may well prove

misplaced patriotism, and the best interests of its shareholders,” Badal

told Stabroek Business.

The Environmental Protection Agency (EPA) had evaluated the rice mill

project and had ruled that the proposed mill will have no adverse

environmental impact, but that decision was overturned by the Environmental

Assessment Board (EAB) after a public hearing and it ordered that an

Environmental Impact Assessment (EIA) be done. Badal feels that this

decision was ultra vires and void in law and did not take account of the

factors required under the law, but extraneous issues. The last recourse

available to the company now would be an appeal to a tribunal if it does not

wish to wait for the EIA.

Badal noted the inconsistency of the situation where an environmental permit

was granted for a cement-bagging plant in the heart of the city at the

Guyana National Industrial Company (GNIC) complex, but a permit for a

state-of-the art parboiled rice mill at Farm, East Bank Demerara, was

overturned.

He said Guyana Stockfeeds made representation to a number of senior

officials in the government to have the issue resolved and even wrote the

President without any success.

Badal also noted the case of a stop order, which was flouted by a large

poultry dealer and says it was drawn to his attention that the government

brokered a settlement between that establishment and the EPA.

However, Stabroek Business was informed that the EPA had referred that

matter to Dr Roger Luncheon after it could not get the poultry company to

comply with its orders and had suggested that an environmental management

plan be prepared to correct the deficiencies as a second measure, but

nothing came out of this either. That project has gone ahead.

Badal says the EAB’s failure to take account of relevant considerations in

reversing the EPA’s decision and the government’s lack of interest to have

the issue resolved requires a full explanation.

“Several persons have mentioned to me that there is a deliberate attempt

underfoot at the highest political level to frustrate the company’s

investment through what is thinly disguised as an environmental issue. I was

even told by one source that carrying out an EIA is a waste of time and

money because “the party boys will frustrate it” through the EAB,” Badal

said.

If the board concurs with the move to Trinidad, Guyana will stand to lose

the sale of one million bags of paddy per annum, which GSI had intended to

purchase from local farmers with a value of $1.5 billion. This is because

the investors in Trinidad will seek cheaper sources of paddy. Guyana would

also lose the Trinidad parboiled rice market of 30,000 tons of rice per

annum and an estimated US$12 million in foreign exchange per annum.

GSI views its US$10M as the best private sector investment ever conceived

for the rice industry, given that it focuses on value added and will enhance

the competitiveness of Guyana’s rice production.

(Back to top)

Crucial loan needed to improve financial management, implement

constitutional reforms

The government is seeking a crucial US$32.5 million loan from the

Inter-American Development Bank (IDB), likely to be approved next month, to

pursue reforms in fiscal and financial management, a component of which will

cover support for parliament in economic policy oversight.

The policy-based loan will support the adoption and implementation of a

series of reforms to the tax, financial management, audit and fiduciary

oversight systems to allow for more efficient and transparent fiscal

management in Guyana.

According to a brief profile posted on the IDB website, the project will aim

to raise revenue levels by increasing the efficiency of the tax

administration and by reducing the tax systems’ distortions, while promoting

horizontal equity. It will also allow for improved management practices to

reduce discretion and increase transparency in the management of public

funds. The project will strengthen the role of the National Assembly in

economic policy, in consensus building and in overseeing policy

implementation. Support will also be provided to operationalise the

constitutional reforms in the areas of public audit and financial and

fiduciary oversight.

The loan carries an investment and technical support component to allow the

government to achieve and sustain the reform benchmarks identified in the

sector reform programme. This will finance the required investment and

operational improvements at institutions to lead the implementation of the

reform agenda. The government’s counterpart contribution required for the

project is US$2.8 million.

The IDB is considering the loan as part of its country strategy for Guyana,

which seeks to maintain a sound macro economic framework for sustained

growth and private sector development, as well as improving governance and

public sector modernization.

“In supporting the strengthening of the revenue base and providing a

framework for the efficient rationalization of public spending, it will help

to underpin the fiscal basis for sustained economic growth. The essential

nature of the activities it aims to support is reflected in the fact that

benchmarks from the programme constitute the majority of the performance

indicators listed in the country strategy paper as triggers for the

maintenance of the baseline lending scenario in the 2002-2003 period,” the

project outline said.

The objectives of the project are to implement a reform agenda to improve

the management of public finances and provide a strong fiscal basis for

sustained growth.

“The proposed operation will assist the government in the implementation of

reform measures that should result in a substantial strengthening of the

operations of the central Government. This will facilitate the efforts to

meet the fiscal policy objectives and targets of the Poverty Reduction

Strategy,” the project outline said. (Back to top)

Commercial Court will

sit in the High Court

- Expected to reduce backlog by 20% in three years

The Commercial Court will operate as a division of the High Court

and Chief Justice Carl Singh says it may sit daily, initially, before its

sessions peter out to once per week as the current Bail Court functions.

Contrary to the perception of many, the court is not going to be independent

of the existing court system as it can function with one or more judges

presiding on a part-time basis over a specified list of commercial cases.

“It is not going to be a separate court,” Justice Singh notes, but will

operate within the existing courtrooms of the High Court. It will rely on

the Supreme Court’s Registry for administrative support for the filing,

servicing and tracking of claims falling under its jurisdiction.

The court and an alternative dispute resolution (ADR) mechanism, being

supported with technical assistance from the Inter-American Development Bank

(IDB), are expected to realize a 20% reduction in the backlog of commercial

cases before the High Court within three years. The current backlog is

11,000 cases, a third of which are commercial cases. The court and the ADR

mechanism are also expected to see a 40% reduction in the time taken to

resolve commercial cases.

Ii is further anticipated that over 200 disputes will be resolved per year

by the second year of the ADR mechanism’s life.

The Office of the Chief Justice is the implementing agency for the project

and a project manager is to be hired. Two judges are to be identified for

training in commercial law to preside over the Court and an evaluation is to

be done to determine how many sittings of the court would be required per

week.

“We have not yet evaluated whether there will be enough work to sustain the

court on a daily basis. The court will perhaps sit everyday. And there may

come a time when the court will sit once per week,” Justice Singh says.

Justice Singh is of the view that the quickest way to start up the court

would be for the Chancellor of the Judiciary, Justice Desiree Bernard, to

issue a practice direction.

As it is, the Commercial Court could be established on the authority of the

Chancellor or by revising the rules of civil procedures in the High Court, a

process currently underway. However, having the revised procedures in place

will take some time, which could delay the operationalising of the court. To

get around this revision process, which also provides an opportunity for a

permanent establishment of the court, the Chancellor can issue a practice

direction detailing the list of matters to fall within the jurisdiction of

the court, as well as the rules of procedure for the management and

administration of such commercial matters. Justice Singh is of the view that

the revision process will not be completed in time to allow for timely

establishment of the court.

Resident Representative of the Inter-American Development Bank (IDB), Sergio

Olea-Varas, has indicated to Stabroek Business that the method of start up

is an issue for the implementing agency.

Because timing is crucial, the IDB has also suggested that the practice-

direction route be taken as an interim measure to allow the Commercial Court

to operate immediately after the judges and the registry staff have been

sufficiently trained. Simultaneously, it says, the Rules Committee could

continue work to include appropriate provisions for the establishment of the

Commercial Court to give it greater legal and institutional stability.

Justice Singh expects that it will take some two to three months to put most

of the arrangements in place, but he feels the training schedule for the

judges would prove to be a ticklish issue and could see some delays in the

process. The judges selected for training (likely to take place abroad as

well), may have different schedules and this could delay the process. As

such, Justice Singh could not specify a time-frame for the start-up of the

court. However, he recognizes the urgency with which it has to be activated

so as to provide a bolster for the investment climate.

“I am very enthused about the Commercial Court because I think we need to

attract investors to our country. Given the state of our economy, everyone

recognizes that if investors do not see and believe in an efficient, strong

and functioning legal system, they will stay away,” Justice Singh says.

He adds that a Commercial Court, which sets itself targets for the

expeditious hearing of matters and the timely delivery of judgment will

certainly “impress potential investors”.

“The Commercial Court also will mark the beginning of special courts and the

accompanying tool of the alternative dispute resolution mechanism will be a

significant contributory factor to the reduction of our case load. The

benefits are many... things can only improve with the establishment of this

court. I see it as a stepping stone for the eventual establishment of a

family court and a constitutional court,” Justice Singh says.

The Commercial Court is expected to deal with banking issues principally and

contracts within the commercial community, as well as trade issues among

other matters of commercial interest.

The judges to preside over the court will be backed by an efficient case

management system. Such a system will be based on strict procedural rules

for the filing of claims, will require conferences with judges prior to

trial, and will have enforced targets.

The Commercial Court is expected to encourage the use of ADR mechanisms,

especially mediation, at the case management conference stage. The IDB notes

in the technical cooperation project document that Uganda’s and Canada’s

experiences have shown that over 50% of the commercial disputes taken to

court can be settled without a trial either in conference or through ADR

mechanisms.

The IDB technical cooperation will fund a case management master from the

Caribbean to lead a comprehensive workshop on effective case management

techniques as well as a case management master from one other common-law

jurisdiction. These practitioners are also to advise the Chief Justice and

other stakeholders in drafting Commercial Court case management rules based

on international best practices. The project will support a visit abroad by

the Chief Justice and the Supreme Court Registrar to consult with case

management masters and to observe effective case management techniques in

another common-law jurisdiction.

Support Services

The Registrar is expected to designate specific staff with

responsibility for the administration of commercial court claims.

A special counter is to be created at the registry to allow for the filing

of commercial claims. Streamlined procedures, guided by commercial court

case management rules, are to be implemented. These include the service of

papers, scheduling of conferences, timely notices to counsel and judges and

record-keeping.

Technical assistance from the IDB will allow for advisory services to be

provided to the Registrar for the planning and implementation of efficient

administrative procedures. Software will be provided for a revised

management information system, including the automation of cause/case book

via the funding of the purchase and installation of case management

software. This software will be used to automate all of the registry cases.

The support will allow for the training of staff including judges, registry

staff, the Registrar, Deputy Registrar and Court Manager on the purpose,

structure and procedures of the Commercial Court including case management

rules and procedures, roles and responsibilities. After every six months,

the project caters for staff to be coached on how to improve their use of

the MIS system and the implementation of procedures.

A week’s study tour will also be financed for the Registrar in another

common-law jurisdiction to observe and develop knowledge of best-practices

in the administration of commercial court cases and case management

procedures.

The project will also provide about five networked desktop PCs, two

printers, miscellaneous accessories and related basic desktop PC training

for the court.

The Judges

Two judges, with some commercial law experience, would be designated by

Justice Singh to preside over the court on a rotational basis.

“While judges in Guyana will indeed benefit from technical training on

commercial law matters [including continuing education on Guyana’s own

commercial legislation], many commercial cases in Guyana are not

particularly complex and the Commercial Court judges’ effectiveness will

depend more on their court management skills, decision-making capacity,

decision-writing skills as well as sensitization to the importance of

enforcement and the economic impact of commercial court decisions,” the IDB

profile of the project says.

Training initiatives will include familiarization sessions abroad on case

management for at least one commercial court judge designate and the Chief

Justice. This will take the form of one-on-one training and observer

sessions with case management masters in foreign jurisdictions.

The judge(s) will also participate in conferences/workshops on court

management. On a regular six-month basis after the court is established, the

judges and their staff would be observed and coached on how to improve their

performance under the project.

The project will also support the purchase of a baseline inventory of

commercial court sections for the Supreme Court Library and will sensitize

lawyers with respect to the procedures and ongoing legal education on

matters of commercial law.

The IDB is budgeting resources to fund at least one workshop to bring

together senior members of the judiciary, the bar, the Rules Committee and

the private sector to review and discuss the Commercial Court provisions and

related case management rules. A workshop may also be required to achieve

consensus on the scope of the Commercial Court’s subject matter jurisdiction

and the finalization of the list of commercial matters to be under the

court’s jurisdiction. The bank recommends that the UN Commission on

International Trade Law base be used as well as other Commercial court lists

such as in the UK, Toronto, Uganda and Jamaica as a reference point. An

international expert is to be funded to advise and assist in such drafting.

Alternative Dispute Resolution (ADR) Mechanism.......

This mechanism will also be located at the High Court building to lend

credibility and legitimacy to its acceptance.

Mediation and arbitration services are to be provided by a roster of

independent mediators and arbitrators. The ADR Committee chaired by the

Chief Justice or the Chancellor and comprising the bar and the private

sector will oversee its administration.

Once it is established and proven, the ADR mechanism is expected to evolve

to be a fully independent non-profit centre with a Board of Directors, an

executive director and a roster of independent mediators and arbitrators.

The ADR committee will prepare a plan for such a centre for review within 18

months of the project being initiated.

The ADR committee is also responsible for the development of standard rules

and procedures, codes of conduct for mediators and arbitrators, as well as

the basic forms.

The project provides start-up capital for the ADR including office

equipment, a basic library of information resources and the funds for one

study tour for the coordinator to observe a successful foreign

court-connected ADR facility.

The service will be user-pay, with fees tiered on the basis of the dollar

size of disputes or be time-based. A fee scheme is to be developed.

The IDB project will finance consulting services to design and deliver

in-country training for six to eight mediators and four to six arbitrators.

Twenty-four lawyers have already received training in mediation techniques.

The IDB’s assistance will provide for the coaching of arbitrators and

mediators at ongoing six-month intervals to allow them to improve their

effectiveness.

There is not expected to be mandatory referral to ADR until the mechanism

has proven itself, but the Commercial Court’s judges are expected to

encourage ADR at the conference management level of cases.

The draft proposed revised High Court rule (33) provides for the court to

“encourage the parties to explore forms of alternative dispute resolution

including mediation and conciliation”. Should this revision be delayed, the

practice direction establishing the Commercial Court is also expected to

include a provision for referral to ADR under its case-management

provisions.

Other sources of case referral to ADR include voluntary decision by parties,

advice of counsel, as well as binding arbitration clauses in commercial

contracts. (Back to top)

Anti-money laundering

laws to bite next year

Full implementation of an amended anti-money laundering law is not

expected to take place until the start of next year, when the new Financial

Intelligence Unit (FIU) is up and running.

The unit was to have been operational by the end of September, but

accommodation for it within the Ministry of Finance is not yet ready.

Additionally, the government has to readvertise for a director for the FIU,

as it cannot afford the services of any of the three persons short-listed

for that position.

Rajendra Rampersaud, head of the policy unit in the Office of the President,

indicates there is a need to identify a sustainable source of financing for

the unit to ensure continuity in its leadership.

The FIU, a semiautonomous agency to trail suspected money-laundering

transactions, will carry out the functions of the Supervisory Authority and

was to have been established since 2000 following the passage of the Money

Laundering Prevention Act (MLPA) in February of that year. However, nothing

was achieved over the last three years.

Earlier this year, the government tasked Rampersaud with the responsibility

to have the unit fully operationalised and he had expected this to be done

by the end of September. His plans were hit by setbacks.

“I now expect that the unit will get going next year in full swing,”

Rampersaud says. He also expects that before the year is out, two identified

support staff for the unit (a police officer and a central bank official)

will be in place at the Ministry of Finance to start laying the groundwork

while the search is on for a director.

As it is, the United States government is providing the physical support

services for the FIU and technical assistance in the form of training will

come from the Caribbean Anti-Money Laundering Programme (CALP). But the

Ministry of Finance first has to complete the refurbishing of the office

space to house the FIU.

And in the current session of the National Assembly, the anti-money

laundering law will be amended to allow for regulations to be gazetted.

Section 12 of the current act is to be amended to make it obligatory for

financial institutions to keep records for all business transactions.

Section 13 will also be amended to require the FIU to investigate and record

all transactions, including the complex, unusual and large ones. The

amendment also prescribes penalties ($25,000) for any breach of the

provisions of the regulations by financial institutions.

The regulations to accompany the amended act have already been crafted and

the government is working to fine- tune the guidelines to be issued to the

commercial banks once the regulations are in effect. All of this is to take

place before the end of this year.

Finalization of the guidelines means that financial institutions will be

able to put systems in place to determine the true identity of their

customers; to recognize and report suspicious transactions to the FIU; to

keep records for six years, to train relevant staff; to liaise closely with

the FIU on matters concerning vigilance, policy and systems and to ensure

internal auditing. Compliance officers are to regularly monitor the

implementation and operations of financial institutions anti-money

laundering systems.

Financial institutions are asked not to enter into any business relationship

with a person unless it has such systems in place. The financial

institutions covered under the regulations include those covered in the

Financial Institutions Act as well as credit unions, trusts, safe custody

services, building societies, immovable property businesses, money

exchanges, money-lending and pawning, money-broking, money-transmission

services, venture-risk capital and firms issuing and administering means of

payments such as credit cards, travellers’ cheques and bankers’ drafts among

others.

Failure to adhere to the requirements of the guidelines could lead to the

revocation or suspension of financial institutions’ licences or carry other

legal repercussions.

The guidelines define suspicious transactions as those inconsistent with a

customer’s known legitimate business or activities for the type of account

he seeks to establish. The guidelines cover new businesses as well as

existing businesses and financial institutions are expected to be on alert

when conducting transactions with existing clients.

Section 3 of the Money Laundering Prevention Act carries a sentence of seven

years and a maximum fine of $1 million or both for money laundering. Aiding,

abetting, counselling, procuring or conspiring to commit the offence carries

the same punishment. Tipping off someone about an investigation or pending

investigation would draw a jail term of three years or $100,000 in fines.

Falsifying, concealing, destroying or otherwise disposing of, or causing or

permitting such actions on any material likely to be relevant to an

investigation or the execution of a freezing order, carries five years in

jail or $100,000 in fines.

Money-laundering is defined as any procedure to conceal the true origins and

ownership of the proceeds of criminal activities and is not only related to

drug-trafficking as is widely believed.

The FIU will be the central national agency responsible for receiving,

requesting, analyzing and disseminating to the competent authorities

information concerning the suspected proceeds of crime. Where the unit

believes it is dealing with money laundering, its reports will have to be

turned over to the police force which is to also benefit from training to

allow for prosecution of suspects. (Back to top)

Domestic debt could

be source of vulnerability

- World Bank

The World Bank has expressed concern over Guyana’s domestic debt

(treasury bills, debentures and bonds), saying it could become an “important

source of vulnerability” if not addressed.

Local analysts, including Professor Clive Thomas and Ramon Gaskin, have

criticized the sustained mopping-up feature of the government’s monetary

policy, contending it is not scientifically validated.

The World Bank’s comments were made in its draft report reviewing Guyana’s

development policy. It notes the surge in Guyana’s domestic public debt,

standing at 71% of Gross Domestic Product (GDP) at the end of last year. The

Bank points out that the interest paid on domestic debt had reached 3.1% of

GDP at the end of last year, compared with an interest on external debt of

4.6% of GDP.

Defenders of the government’s monetary policy have argued that the exercise

is crucial to ensure that inflation levels are kept low and to allow for

stability in the exchange rate by preventing capital flight. But critics

point out that Guyana’s economy is not characterized by too much money

chasing too few goods (the source of inflation) but rather inadequate

purchasing power in the hands of a majority of its citizens. The critics

also note the effect fuel-related products have had on inflation.

Additionally, they say that capital flight is fuelled by the instability of

the currency itself and not the other way around. This instability is as a

result of demand and supply for the currency with supply constrained by a

trade deficit. The currency has moved from $111.8=US$1 in 1991 to $200=US$1

today - a 78% decline.

“I am not saying that the government should not intervene as the situation

warrants and defend the currency or fight inflation with sterilization as a

tool in monetary management. What I am saying is that this sustained mopping

up is not scientifically validated and has lost its effect as a tool of

monetary policy in Guyana,” Gaskin says, a position which has also been

expressed by Dr Thomas previously.

At the end of June of this year, deposits in the banking system had hit $104

billion (residents only), a growth of 3.2%, while inflation over the same

period was 3.7%. However, the stock of treasury bills, debentures and

government bonds reached $54.7 billion at the end of June, 1.8% more than

the end of December level.

Gaskin argues that his experience in the banking sector taught him that

persons rarely touch their savings for consumption and if they do, they

would replace them as soon as possible. This, for him, is because of the

stable culture of savings in Guyanese.

As it stands, the interest rate paid by commercial banks on deposits, when

inflation and taxes are deducted, do not yield a positive return and this in

itself should have been a factor to influence capital flight, according to

Gaskin. However, he points out that deposits are at its all-time highest in

the financial system. He argues that those persons who seek to preserve the

value of their savings against depreciation and inflation will take their

money outside of Guyana and the mopping up exercise will not stop this.

The stock of debentures at the end of June stood at $3.8 billion, while

91-day treasury bills were $3.2 billion (an increase of 9.6%), 182-day

treasury bills were $7.5 billion (an increase of 50.1%) and 364-day bills

were $37.6 billion (a decline of 4.3%). Defence bonds stock was $4 million

(a reduction of 8.3%).

“The increase[s] resulted primarily from the issuance of treasury bills to

sterilize excess liquidity in the financial system as the stock of defence

bonds declined by 8.3 percent or $0.3 million to $3.5 million, while

debentures remained unchanged,” the Bank of Guyana says in its just released

half-year report.

Domestic debt servicing totalled $1.424 billion at half year, 36.9% less

than the same period last year and resulted from lower interest charges on

the stock of treasury bills and debentures redeemed. Interests on 91-day and

182-day treasury bills fell by 51.4% and 29.3% or by $57 million and $84

million respectively. Interest on the 364-day bills and debentures also fell

by 36.6% and 47.3% to $1 billion and $61 million respectively.

However, the total stock of outstanding treasury bills increased by five

percent from its end June 2002 level but rose by only 2% during the first

half of the year. The report says that the maturity structure of the

outstanding stock of treasury bills changed from one year earlier, shifting

towards the shorter term.

The commercial banks continue to hold the largest share of the outstanding

stock of treasury bills at 50.9%, 5.3% more than the year before. The public

sector’s share, of which the National Insurance Scheme is the only

stakeholder, contracted to 23.9% from 29.1% while the share of the other

financial intermediaries decreased by 0.4% to 21.9%. The share of the

private sector contracted to 0.2% from 0.6%.

Treasury bills issued during the first half of 2003 amounted to $34.6

billion, 9.2% higher than the comparable period last year. There was no

issue of debentures. Redemption of treasury bills totaled $33.7 billion with

redemptions for the 182-day issue moving up by 34.1% and the 364-day issue

by 5% or to $10.1 billion and $17.4 billion respectively. The 91-day

treasury bill maturity decreased by 15.9% to $6 billion. There was no

redemption of debentures.

On the other hand, the stock of outstanding external debt amounted to US$1.2

billion or $238 billion, 1.3% higher than the end of June 2002 balance but

0.02% or $0.2 million lower than the end of December 2002 level. The

increase, the bank says, reflects the impact of an appreciation of the Euro

on the Euro-denominated portion of the stock of debt and disbursements

received under existing loans.

External debt service payment increased by 21.9% to reach US$25.2 million,

contributing to a higher debt service ratio of 10.5% compared with 8.6% in

the previous period.

Total debt relief under the HIPC initiatives during the first half of the

year was US$19.8 million, a 1.8% increase. Relief under original HIPC was

US$12.2 million or 13% less than the previous year. Interim HIPC assistance

amounted to US$7.6 million, 39.6% higher than that received in the first

half of 2002.

A preliminary analysis of Guyana’s external debt sustainability has

indicated a drop in the external debt to GDP ratio to 75% after the EHIPC

completion point. At the end of 2002, debt to GDP stood at 71.5% and NPV of

debt to revenue stands at over 400% compared with the EHIPC benchmark of

250% and NPV of debt to export at just under 150% (as in benchmark).

“The continuation of this trend would make it difficult to reach the fiscal

target and completion point (for EHIPC) could be delayed further,” the World

Bank says in its draft report. Guyana is expecting to reach floating

completion point next month to achieve a further US$25 million in annual

debt-service relief.

The bank concludes that debt management in Guyana remains a concern with

domestic and foreign debt managed independently, the national debt committee

inactive and each ministry being able to negotiate and borrow without an

assessment made of the efforts of new borrowing on debt sustainability.

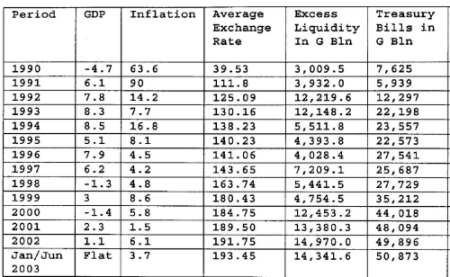

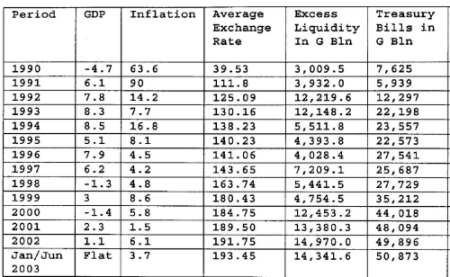

Source: Bank of Guyana Annual Report

From the table, there seems to be a direct relationship between the

depreciation of the currency and inflation. That is, while the Guyana dollar

lost 54% of its value between 1992-2003 using the average exchange rates for

the period, the level of prices (inflation) went up by 86%. The relationship

becomes clearer when it is noted that prices for imported goods move up in

line with the depreciation of the Guyana dollar.

The balance of trade deficit dates back for many years and has a direct

bearing on the value of the currency, as it reflects itself as a supply

constraint.

There seems to be no direct relationship between the stock of treasury bills

and the rate of inflation. As can be noted, when the excess liquidity was

$3B in 1990, the government stock of treasury bills was $7.6B, more than

doubled the level of the liquidity. However, inflation was 63.6%. When

liquidity was $5.5B in 1994 and treasury bills amounted to $23.5B, more than

4 times the liquidity, the inflation rate was 16.8%. In the three years when

the liquidity was determined to be in the region of $4 billion, t-bill stock

was $22B, $27B and $35 billion. However, the corresponding inflation rates

were 8.1%, 4.5% and 8.6%.

The high levels of inflation in the late 80’s had been attributed to the

printing of the Guyana dollar to close budgetary deficits.

(Back to top)

More Essequibo fuel

businesses deny smuggling

By Yohann Earle

Essequibo River fuel retailers have all denied allegations of smuggling

and some have even produced bills to show that their products are legally

obtained.

But residents in the area insist that some of these retailers sell illegally

obtained fuel. The residents say they can detect the smuggled fuel, since it

burns faster than the gasoline purchased at the legal pumps and is different

in colour and odour.

The Guyana Energy Agency (GEA) recently told Stabroek Business that some of

these businesses buy fuel from Venezuela for “next to nothing” prices, which

are usually only available to Venezuelan nationals. However, Guyanese

living in Venezuela and who are eligible to source the cheaper fuel

facilitate these purchases.

One boat owner told Stabroek Business that a drum of gasoline from Venezuela

costs $14,000 but fuel through any legitimate dealer can cost over $20,000

per barrel.

From the start of next year, the GEA will introduce a system of fuel marking

in an attempt to discourage smuggling. An additive will be put into the fuel

on importation and this will allow for its identification by investigators

scouting out illegal sources of fuel. The GEA has assured that even if the

marked fuel is mixed with other products, tests to be carried out will

detect this and persons to whom the fuel belongs will be liable for

prosecution.

Essequibo and the Corentyne are seen as the two points of entry for illegal

fuel into Guyana and areas such as Morasi, Lanaballi and Fort Island on the

Essequibo have been targeted for anti-smuggling operations by the Customs

and Trade Administration (CTA).

Stabroek Business visited Morasi, Lanaballi and Fort Island recently to

assess the state of the fuel market in these areas.

At Lanaballi on the right bank of the Essequibo River, Looknarine Persaud,

also known as ‘Scott’, is one of the persons in the fuel trade. Farmers,

boat owners and miners purchase fuel from him but he denies any association

with illegal fuel from Venezuela. Persaud has been in the business for the

last 18 years.

He produced bills from the Guyana Oil Company (Guy-oil) to prove his claim

that he buys some 3,000 gallons of gasoline and about 4,000 gallons of

diesel per month. He contracts vessels to transport the fuel to his location

at a price of $9 per gallon. Guyoil has confirmed to Stabroek Business that

it sells the quantum of fuel cited to Persaud.

Persaud confirmed that officers from the Customs and Trade Administration (CTA)

make periodic checks for illegal fuel at his establishment.

“They check the bills and they also check to see when was the last time you

bought fuel,” he explained. He also said that personnel from the Guyana Fire

Service would check the tanks to ensure the proper storage of fuel.

Persaud sells mixed gasoline for $580 per gallon and plain gasoline for $480

per gallon. He also sells diesel, kerosene and various grades of lube oil.

Persaud’s operation is isolated, located immediately at the waterfront in

the Essequibo River. There were no other signs of habitation. He also

operates a general store to supply miners, farmers and others frequenting

the interior. His operation is only accessible by boat.

Stabroek Business also checked out the mini-gas station at Morasi, nine

miles from Parika and some 40 minutes before Lanaballi. The owner of that

operation was not in but a heavy odour hung over the air to which residents

had their own tales to tell. The scent was not similar to what prevails at

gas stations.

And one man on Fort Island confessed to Stabroek Business that he and many

others on the island sell small quantities of gasoline although none of them

had licences to do so. The majority of the fuel is sold to the four or five

persons on the island who own small power generating sets, he said, and the

rest is sold to farmers and boat owners.

The man said that he and the other dealers on the island buy fuel from

Shairaz Ali of Vergenoegen, East Bank Essequibo, owner of the Two Brothers

Gas Stations. The man said he sells about four or five gallons of fuel per

week. Asked whether anyone from customs has been checking on the sale of

fuel on that island, he said not in recent months.

Stabroek Business visited a yard on the island, which was full of oil drums

and was informed that this was one of the places dealing in smuggled fuel.

But no one was at home to answer the charges.

Another man on the island said that some months ago the authorities

conducted a raid on the island checking for smuggled fuel but he could not

say what was the outcome.

At Aliki, also located on the right bank of the Essequibo River, Stabroek

Business saw a sign which read: ‘Gas and Kero for sale’. An investigation

revealed that Vibert English had erected this sign in order to advertise his

small venture. He told Stabroek Business that his operation is “a small

thing,” which he runs on an ad hoc basis.

When he was operating, he says, he would sell five, ten or 15 gallons per

week. Asked who supplies his fuel, English replied, “I does buy from Scott

(at Lanaballi)”. He said he had been licensed by the Fire Service to ply his

trade.

The other islands in Essequibo are also suspected to deal in smuggled fuel

but Stabroek Business was unable to make a trip to them.

Ahmad Amin, owner of a gas station at Sans Souci, Wakenaam, had denied

recently any involvement in smuggled fuel. An official of Two Brothers owned

by Shairaz Ali had also denied similar allegations.

H.N. Sugrim of the Corentyne has also been under customs surveillance for

smuggled fuel but he has denied any association with smuggled fuel.

(Back to top)

Trade fairs

prove good showcases for smaller companies

Trade fairs and exhibitions come and go and are generally seen as a

form of entertainment for most patrons, especially as the sessions wind

down, as opposed to an avenue offering serious business propositions to

those exhibiting their products.

The usual faces at these fairs include Demerara Distillers Limited, Laparkan,

Fibre-Tech Industries, Banks DIH, the phone company and others who continue

to see benefits from advertising their products.

This is not to say that new products from smaller companies do not receive

good promotion at these fairs. For example, Suprya’s Delight, a little

confectionary outfit which sells packaged peanuts, cashew nuts, almond nuts,

mixed nuts and even chopped nuts, was able to catch the public’s attention

as did the Nieuw Image clothing line by Jocelyn.

Perhaps one feature that goes unmentioned by many from these fairs is the

number of small businesses which surface with the potential to carve niches

in the non-traditional sectors, create jobs, generate income and garner

foreign exchange. It is also noteworthy that many of them source a higher

percentage of their raw materials locally than the larger companies.

Stabroek Business spoke with the owner of a few businesses at the most

recent fair held at the Sophia Exhibition Centre. Others chose not to be

quoted while some did not want to disclose the financial aspect of their

business because of security and tax concerns.

From two tarpaulins, Samuel Wicker rises

Samuel’s Wicker, Rattan and Upholstery Works had one of the more

eye-catching displays. The boat-designed and egg-nest looking chairs were

the favoured pieces for many, including security guards who could not resist

taking a break in them.

Their sunny colours make them ideal for patios and sunrooms. But it will be

later this year that Guyanese would be able to purchase the wicker and

rattan products as all of the products are exported. However, owner

Praimroop Prasad says he intends to start supplying the domestic market

sometime later this year.

Prasad, whose business is located at the Eccles Industrial Estate, recalls

his very humble beginnings from contraband trader dodging customs officials

to exporter and earner of foreign exchange.

It was “with Jesus wallaba posts and two tarpaulin, a very small capital of

$60,000, and loans from IPED” that he established Samuel’s Wicker, Rattan

and Upholstery Works in 1997 to export all of its produce to a niche market

in Barbados. Prasad is a former employee of a furniture upholstery store and

switched to trading in contraband in the 1980s. He brought in flour and

other banned food items from Suriname for sale in Guyana, until he could no

longer deal with the difficulties posed by evading Customs.

When he saw the market opportunity in Barbados, he seized it, and began

sourcing wicker products for exports out of the Pomeroon river where a large

community of families work on wicker furniture. But because of the demand

for high quality products in the regional market, Prasad decided to

manufacture the furniture himself. He recalls that when he approached his

suppliers, he was flatly informed that they could not produce a higher

quality product than they were producing.

Prasad sources 90% of his materials from within Guyana. The foam for the

cushions he buys from AH&L Kissoon Ltd while Amerindians supply the raw

material for his wicker and rattan produce.

Business, Prasad says, has been slow for the year so far but is picking up.

Craft industry needs duty-free concessions too!

Eighteen years ago, Trevor Alfred graduated from the Burrowes School of

Art and began literally using his hands to earn a living.

He spends his time making pottery and sculptures and painting to produce

ceramic pottery for sale. Using earthen clay and a small amount of kaolin,

he makes moulds which he then burns in a kiln before applying a glaze to

give it a finish.

Alfred makes decorative plates in various sizes and with terra-cotta

designs. He also produces mugs (including beer mugs), miniature vases, wine

sets and even orange juice squeezers as well as bowls. Additionally, he

makes little trinkets such as soapstone necklaces and clay pendants with

various zodiac designs.

His products are known locally, having been supplied to Guyana Stores until

its privatisation. He also supplies the Hibiscus Plaza in front of the

Guyana Post Office and the Craft Shop at the Amerindian Hostel. Alfred also

has a small gallery at his residence at Supply, East Bank Demerara.

Alfred is keen to get into export markets in a big way, having showcased his

products in Barbados, Martinique and Antigua through the Guyana Office for

Investment.

“It is a profitable business and it would be good if the government can look

into assistance for us as these little produce can bring in foreign

currency,” Alfred says. He adds that the craft industry could be bolstered

if the government provided duty-free concessions for the importation of the

tools of trade on a large scale, including ovens and machinery. As it is,

local sales are not sufficient to allow Alfred to remain a self-employed

person.

Linden supporting tourism

Coretta Braithwaite focuses her energies on creating leather and craft

as well as hand-painted cushions and jerseys to target the tourism sector.

From Half-Mile Wismar, Coretta has been doing this for ten years but

business is currently slow with her returns much less than $5000 per month.

However, she explains this is very much a seasonal trade as her returns

during Mashramani, Easter, and in the July, August and December periods make

up for the slow sales the rest of the year. Her monthly returns in these

periods average $40,000.

The Linden Economic Advancement Programme (LEAP) sponsored her participation

in the fair and also facilitated her participation in subsidised courses to

improve her management skills. She said her presence at the exhibition was

to actively seek unexplored export markets, in territories such as Antigua,

St. Maarten, St Croix, and Tortilla. Additionally, she would like to secure

contracts to supply the police force or the power company with safety boots

and utility belts.

Braithwaite uses all natural material to make her products. The leather in

her craft is sourced from local cows and the straw, bamboo and lucky seeds

are from her yard. The string, which she uses to make curtains, comes from a

hinterland vine. She makes car seats, hats, bags, fans and other items from

tibisiri, which comes from the Ite palm. Braithwaite strips the leaves of

the palm and dries them in the sun to make the straw.

Transforming waste into art

Iris Calistro, 58 years old of Kabacaburi with nine children, began

experimenting with coconut fibre and balata latex as a means of producing a

value-added product four years ago.

With encouragement from Beacon Foundation and Dr Leslie Chin of the

Institution of Private Enterprise Development (IPED), Calistro and a group

of 12 persons began applying their hands to converting balls of coconut

fibre into filling for mattresses.

But after 14 mattresses were produced, all of which were purchased by Dr

Chin, the project died a natural death because of a lack of commitment and

inadequate responses from businesses to keep it going.

But Calistro decided to try her hand at a new product - broad brimmed hats.

“I looked at the coconut fibre and said you know what, I could make a hat

from this....and it came out good. I used a bowl as the mould. I showed it

to the rest of the people in my area and they were impressed and I began

making more hats,” said Calistro. She sold the first few for $600 a piece

but her price has since increased to $1000 per hat. And she has been taking

every opportunity to showcase her new creation including at the recent

Amerindian Heritage Month celebrations at Umana Yana.

She not only makes hats from the fibre but also does plant-baskets and

shoulder-bags. She uses tibisiri to make placemats, shoulder-bags and

jewel-boxes, which fetch better prices.

Calistro said that she would very much like to get into the export-market

and expects assistance from the Guyana Office for Investment to further the

process.

“We need help to export our products, we would like to export...” says

Calistro.

Designer seeks markets

Derrick Alphonso, owner of Alphonso’s Modern Tailoring Establishment, is

from Linden and is a tailor and designer by profession, a passion he

discovered after he left school.

His clothes are quite popular in Linden as well as in the city and LEAP

invited him to share a spot in the booth it sponsored at the recent trade

fair.

He jumped at the opportunity to promote his business further and would

welcome if it materialises into export markets. His designs are quite

attractive with their own distinctive appeal. His finished products,

however, he feels, can be improved if he can source modern machines and

improved technology. This will allow him to finish his orders much faster.

His business currently employs two persons.

Alfonso is also into HIV counselling in Linden at the Linden Care Foundation

and he is also vice-chairman of the Regional Rights-of-the-Child Committee,

Region Ten. He is currently pursuing a degree in Social Work at the

University of Guyana.

Juggling to make ends meet

Using local material such as leather, wood and semi-precious stones,

Anthony Hopkinson specialises in hand-made jewellery such as earrings,

bands, chains and necklaces.

A resident of East Ruimveldt, Georgetown, his interest in craft was ignited

one day when he noticed someone putting together such jewellery during a

basketball game and five years later, he is still in the trade.

Hopkinson attended East La Penitence Primary School and Lodge Community High

School, but says he was never the school type so he dropped out.

Life before craft involved work as a carpenter and mason and he is currently

doing electronics at Abdul’s Electronics. Electronics offers him an

insurance policy if his present occupation falls apart.

His initial investment five years ago was about $10,000 and Hopkinson says

he has recovered this sum. But these days returns are not steady. He says

this is his fifth exhibition and the returns are not as good as they should

be. (Back to top)

Restructured PSC

is stronger, more representative

- says deGroot

The Private Sector Commission is today viewed as a much stronger

organisation and should be seen as being politically neutral, says its

chairman, Dr Peter deGroot.

The PSC played a leading role in the Social Partners’ Initiative last year

and this helped to put the organisation into a politically neutral

limelight.

Since last year, the PSC has had to undergo its own restructuring, followed

the loss of its Honorary Secretary/Executive Director, Mr David Yankana as

well as the head of its Economic Policy Unit and associated staff. deGroot

said these losses provided the PSC with an opportunity to find fresh blood

and invigorate itself.

As a result of this restructuring, the PSC is now run by an executive

committee. This comprises the chairman, his deputy Ramesh Dookhoo, Paul

Cheong as treasurer and Claude Merriman, secretary along with Michael

Correia as a committee member. The PSC’s new Executive Director, Bal Persaud,

also sits on the executive committee. The Council remains the final decision

making forum of the organisation.

The PSC now has four functioning subcommittees with Rodney Gun-Munro heading

the trade and investments arm, Merriman the public relations arm, Cheong the

finance arm and Norman McLean, the governance and security sub-committee.

The PSC, the umbrella private sector organization, has been accused in the

past of being an elitist club with individuals using the body to pursue

their vested interests rather than the collective interest of the membership

and the PSC as a whole.

But deGroot makes the point that to get proper representation at the PSC

level, businessmen have to ensure that they promote their concerns at their

umbrella association level for it to be taken to the PSC Council for action.

Corporate members of the PSC also need to ensure that they attend meetings

and have their voices heard.

As it is, the PSC is now looking at what role it can play to assist those

businesses not represented by any formal organization.

deGroot holds the view that there are too many private sector organisations

around today and many of these lack the wherewithal to represent their

constituent members.

He says the PSC is looking at how it can provide help and bring these

organisations within its fold as achieved by the Private Sector Organisation

of Jamaica (PSOJ).

For example, the Guyana Rice Millers and Rice Development Association is

almost defunct and a number of other organisations are losing members. But

not every business house can afford to be corporate members to be able to

have direct access to the PSC. As such, the PSC hopes to come up with some

measures to allow for effective representation of a wider section of the

business community. (Back to top)

CGX

seeks US$750,000 locally

- prospectus filed with the Securities Council

Onshore (ON) Energy Inc, a wholly- owned subsidiary of CGX, has

filed a prospectus with the Guyana Securities Council for clearance to raise

US$750,000 to fund preliminary exploration for oil and gas on the Berbice

block of its prospecting licence.

|

This map exhibits the CGX onshore block, the oil and gas show while

drilling, the Staatsolie geochemical anomalies and the surface oil show. |

CGX on September 18 announced it had begun exploration on the 377,500-acre

onshore portion of its Corentyne Prospecting Licences through ON Energy and

intended to do so in three phases, each subject to modification and

contingent on the positive results of the prior phase.

Two days earlier, the company had filed with the Guyana Securities Council a

prospectus to raise US$750,000 by issuing 15 million shares valued US five

cents each and equivalent to 20% of the equity of ON Energy Inc.

Additionally, on October 6th, the firm announced that it has retained CMMB

Securities Limited of Trinidad as agents to raise new equity capital through

private placements for CGX’s exploration and corporate activities.

“It is the intent of ON Energy to externally finance preliminary exploration

with the money to be raised in Guyana or other Caricom member countries,” a

recent statement from CGX said. Negotiations have started with investors in

Trinidad for an equity stake in CGX, but this is separate from the

prospectus filed locally.

The company filed its prospectus with the Guyana Securities Council on

September 16th and the Council issued a receipt on September 29th. However,

clearing the prospectus for its public issue is expected anytime soon.

In June of 2000, the United States Geological survey of undiscovered

conventional oil and gas resources in 23 basins in South America, Central

America and the Caribbean ranked the South and Central America regions as

third in the world for undiscovered oil and gas resources behind the Middle

East and the former Soviet Union.

The potential for undiscovered giant oil and gas fields is expected to be

greatest in offshore basins along the Atlantic margin of eastern South

America, from the Santos Basin in the south to the Guyana-Suriname Basin in

the north. The potential for additional giant oil fields in the Maracaibo

and East Venezuela basins is considered to be much less, but these basins

(and offshore Trinidad) were estimated to contain significant undiscovered

oil and gas resources, that assessment found.

Warren Workman, Vice-President of Exploration with CGX, says the presence of

an active petroleum system and the hydrocarbon potential of the offshore

Guyana-Suriname basin is supported by the 900 million barrels of oil in the

onshore Tambarjedo field (Suriname), some 200 kilometres east of CGX’s

Berbice block as well as the oil and gas shows in most of the offshore

wells.

The company in Suriname, Staatsolie, has done extensive aero-magnetic and

geochemical sampling and has identified several anomalous leads along a

fairway inclining toward the Berbice block.

Workman in a recent interview with Stabroek News said CGX’s decision to

return to exploration was informed by the current production situation in

Suriname, the seeps in a number of older wells and the anomalous leads.

“I am optimistic (about a possible oil find) with the precaution that it is

a new base for production. It is high risk to expect that the first well(s)

will be successful.

However, the presence of oil in the Tambarjedo field near Paramaribo,

Suriname, is encouraging and indicates that there is a reasonable chance for

gas and oil currents, “ Workman said.

ON Energy on October 1st began a geochemical survey, which requires the

acquisition of soil samples and this survey will run for six weeks. The

company has eight sampling teams following roadways, trails, rivers and

creeks and assessing plantations and farmlands to carefully extract soil

samples of about 1 kilogramme each, using a shovel. The company plans to

extract a minimum of 5000 samples.

Following assessment of the findings of this survey, ON Energy will have to

determine whether it will need to do additional geophysical work or proceed

to seismic or drilling operations.

CGX has transferred its onshore block to ON Energy. Its offshore block

comprises the Eagle and Wishbone properties. Suriname gunboats had chased

CGX out of the Corentyne River in 2000, as it was about to commence drilling

for oil. CGX shares closed trade last week at CDN 45 cents per share on the

TSX Venture Exchange, Canada public venture capital marketplace.

(Back to top)

Plummer seeks US$3M plug

for Globe Trust

Administrator of Globe Trust and Investment Company Ltd (GTICL),

Conrad Plummer, is seeking to raise US$3 million to re-capitalize that

financial organisation.

In an offer open to individual investors, Plummer is offering controlling

interest in Globe Trust of at least 51% of the stock.

According to Plummer, Globe Trust shares as they stand carry no value and

their future value is debatable. In advertisements placed locally,

regionally and internationally, he has invited potential investors to

express their interest in the reorganization of the firm, which could take

the form of various financial instruments, including equity.

According to the advertisement, 57 individuals collectively represent 24.6%

of the current shareholding and all of these shareholders except three

individuals hold less than five percent of the shares.

Investors desiring to control the institution will have to meet the Bank of

Guyana’s fit-and-proper test requirements and would also be required to

submit a three-to- five-year business plan.

Asked what timeframe is needed to turn the institution around, Plummer said

a lot will depend on this current phase and the direction in which the

investor may want to take the company.

“If after the investment the company remains cash-strapped, then it will

face a protracted period of rebuilding, but if it acquires the necessary

resources — financial and human — at the time of the investment, then the