| Related Links: | Articles on economic concerns |

| Letters Menu | Archival Menu |

Introduction

Today’s Business Page presents the first of two parts featuring the 2001 Annual Report of the National Insurance Scheme, Guyana’s national social security system established over thirty years ago to provide compulsory coverage to the country’s employed and self-employed population. During the seventies, it became a useful source of funds for the government which practically dictated the terms under which it commandeered the large amounts of funds the Scheme held. More recently, as the Scheme moves into a mature phase, it appears to be having problems of arguably a more fundamental nature, which threaten its very viability. Independent professional actuarial recommendations are ignored by the political directorate, while the labour movement, the opposition political parties and the private sector appear oblivious to or uninterested in the clear signs of danger.

The 2001 annual report of the National Insurance Scheme was submitted to the Minister of Finance under cover of a letter dated April 30, 2002 (shown on page 9 of the Annual Report). Amazingly, the auditors report was dated January 28, 2003 (on page 62), months after the Annual Report was purportedly forwarded to the Minister.

This regrettably is not an oversight, but just one of several cases over the past ten years of the NIS misrepresenting that it is more compliant with the law than is the case. At the time of preparing this article the 2002 Annual Report is not yet available, which is not unusual. More often than not over the past eleven years the NIS Board has failed to submit its Annual Report within the time prescribed in the Act. Compounding this failure is that instead of acknowledging this impropriety, the transmittal letters continue to misrepresent the situation and very often predate the auditors’ report! Not since 1992 has the Scheme issued a transmittal letter which was dated after the date of the Auditors’ Report and submitted within the six month statutory deadline.

This disrespect for the law does not stop at the Board level however. It has obviously been condoned by successive Ministers of Finance not only by their failure to sanction the directors who are responsible for the breach, but extends to their own failure to table the report in the National Assembly as required under the Act. One has to ask how many Members of Parliament are even aware of this requirement let alone seek to question why it is not done.

President Jagdeo emotionally dismisses criticisms of poor governance levelled at his Government; but how can he tolerate this dereliction of duty from a Board that since 1992 has been chaired by the Head of the Presidential Secretariat and includes one of his own Members of Parliament and that manages almost twenty billion dollars in workers’ money? And from a Minister of Finance who demonstrates such unfamiliarity with the principles and practices of good governance not only in relation to the NIS, but also in relation to the Guyana Revenue Authority Act for which he has so far not tabled a single Annual Report in the National Assembly. It is therefore ironic that Minister Kowlessar should have reacted as strongly as he did on the draft report by the World Bank on governance in the country. As the only authority formally in place to oversee the operations of the NIS, the Minister has to be taken seriously by the workers and their representatives since as this column will show, the viability of the Scheme cannot be taken for granted. The TUC has to take a stand on the matter.

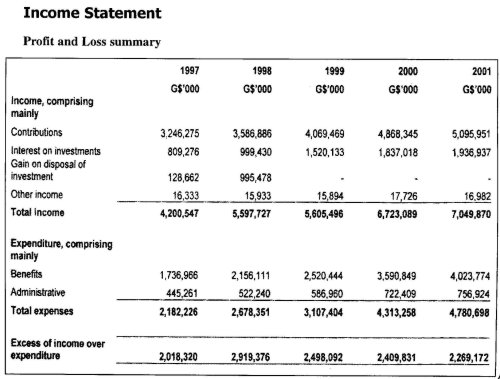

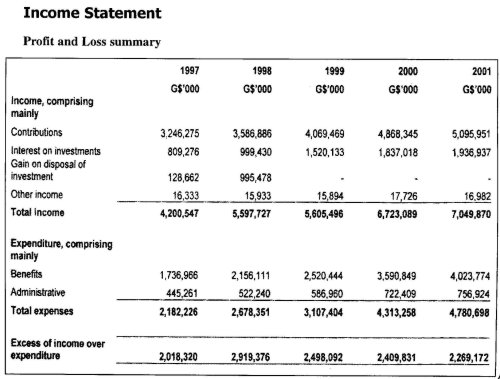

The table whose source is the audited financial statements of the NIS reveals that the surplus of income over expenditure for the year 2001 has continued the decline which began in 1998, when the total surplus was almost three billion dollars but with close to $1Bn derived from the disposal of investments. Surpluses in 1999, 2000 and 2001 were $2.498Bn, $2.409Bn and $2.269Bn respectively. The surplus in 1992 was a more modest $344.9Mn.

Revenues represent mainly contributions and income from investments. Contributions which are levied on employers through the payroll part of which is borne by the employees increased from $3.3Bn in 1997 to $5.1Bn in 2001, or by approximately 56.9% over the period. During the same period income from investments increased from $809Mn. to $1.9Bn. or 139.34%. If 1992 is used as a reference point, contributions have increased from $769.8Mn to $5.095Bn in 2001 or some 562%.

Payments out of revenues also increased during the period, with benefits moving from $1.7Bn in 1997 to $4.0Bn in 2001. The principal benefits paid in 2001 are Old-age benefit of $2.441Bn, Survivors benefit of $497Mn, Medical care-sickness of $374Mn and Sickness benefit of $217Mn. Administrative expenses made up mainly of employment costs of $481Mn, other administrative costs of $124Mn, Security of $48.7Mn and Gratuities and pensions of $29Mn increased more modestly from $445Mn. to $757Mn. or 69.9%. Ten years ago administrative expenses amounted to $208Mn which means that over the ten year period they have risen by 263%.

Because of apparent reclassification of certain expenses it is not possible to identify with certainty all the increases between 1997 and 2001 except for increased employment costs of 69.48% from $283Mn in 1997 to $481Mn in 2001 and finance charges from $835,000 to $2.47Mn in 2001.

In what must be a cause for concern by the actuaries and indeed by all who have an interest in the viability of the Scheme, benefits as a percentage of contributions have risen dramatically over the five years from 50.4% of contributions to 78.9% in 2001, while expressed as a percentage of total income, benefits have increased as a percentage of total income from 40% to 57%. To compound this difficulty or perhaps causing it is the failure of the Board to implement the recommendation of the actuaries to increase contributions from 12% to 14.7%. It is dangerous for a Board to refuse to accept a recommendation from actuaries and in the process risk the future of the Scheme and the security of the pensions and other rights of the workers.

In the audit opinion on the 2001 accounts, auditors Deloitte & Touche cautioned, without qualifying their opinion, that the Actuaries in their report of 31 December 1998 recommended that to ensure future viability of the Scheme the contribution rate should be increased but that this and certain other recommendations by the actuaries were not implemented as explained in Note 8 to the financial statements.

To understand the seriousness of the failure Business Page reproduces note 8 in full:

“The following recommendations were made by the Actuaries at December 1998 for the future viability of the scheme.

(i) A rule be stipulated in the National Insurance Scheme Act that the contribution rate of the Pension branch will be established such that the reserve ratio of the branch is equal to 4.0 in year 2010, 2.5 in the year 2030, 2.0 after year 2040. This will necessitate contribution rates for the next seven years to be charged as follows:

1999 - 12%

2000-2003 - 14.7%

2004-2006 - 16.2%

(ii) Each benefit branch of the scheme should have its financial autonomy, instead of allocating total income and expenditure to various branches according to arbitrary percentages.

(iii) Amounts of $796Mn and $1,575Mn could be transferred from short-term benefits and employment injury benefits (industrial benefits) branches respectively, to the long-term benefits branch to comply with recommendation (ii) above.

(iv) The contribution rates for the short-term benefits branch should be 2.2% and the employment injury benefits branch (industrial benefits) 1.5%. These contribution rates should remain constant at their 1999 levels until the next actuarial review.

(v) An investment portfolio diversification should be contemplated.

(vi) The Board should plan to reduce its administrative expenses below 1.5% of insurable earnings over the next five years.

As of December 2001, items (iii) and (iv) were implemented during 1999 and items (1), (ii), (v) and (vi) are under consideration by management and were not fully implemented to date”.

Business Page regards this failure on the part of the Board as financial irresponsibility which puts the entire Scheme at risk. With contributions below the recommended level for almost four years and with the effective rates of personal taxes already very high, it is hard to see any shortfall coming from future increases. And if it has to come from central government, who pays? Workers must now look forward to the 2003 Actuarial Review with anxiety bordering on fear.

Introduction

Today this concluding part of the review of the Annual Report of the National Insurance Scheme for 2001 begins by looking at the resources which the NIS has accumulated since it began operations in 1969, and how those resources are deployed. The reserves at the balance sheet dates over the recent past were $2.2B at December 1992, $8.8B in 1997 and $19.3B at December 31, 2001, a 777% increase since 1992. The funds are largely held in bank deposits, Government of Guyana securities and increasingly investments in private sector companies both listed and unlisted.

Investments in private sector companies have increased from $20M in 1992 to $1,667M in 2001, representing respectively 1% and 9.4% of the total value of investments. The companies in which the Scheme has invested fairly significant amounts were:

1. Laparkan Holdings Limited,

2. Courts Guyana Inc

3. Guyana Bank for Trade and Industry

4. Demerara Distillers Limited

5. Demerara Bank Limited

6. Guyana Co-operative Insurance Service

7. Guyana Stores Limited

8. Neal & Massy Guyana Limited

9. Guyana National Printers Limited

10. Citizens Bank

11. Pegasus Hotel

Over the years, the Scheme has been criticised for its failure to adopt a coherent investment strategy, and its current portfolio includes a mix of loans and shares in both public and private companies. Despite the composition of the investments, the accounts do not give any details of the income from these major categories to facilitate a comment on the yield from the respective sources. The average yield on the entire portfolio of investments for the year 2001 was 11.62% compared with a yield of 11.8% in the preceding year. There has to be some doubt as well whether all the investments are fairly stated, and there seems to be a pressing case for a review for possible impairment in the values at which the investments are carried in the books.

The notes to the accounts for the past several years show that the Scheme holds 2,500 in Citizens Bank at a cost of $32,500,000, suggesting a staggering price paid of $13,000 per share which must be incorrect. The accounts also show that the company owns 100,000 shares in Neal & Massy Guyana Limited, for which it paid $100M. On the other hand the annual return of Neal and Massy filed at the Deeds Registry shows that the company owns 20M of the 519M shares issued by the company, making the NIS the largest shareholder after the Trinidad parent.

Loans

Since 1996, the Scheme has been extending to Laparkan Holdings what appears to be revolving loans to facilitate “major expansion” of its hire purchase programme. At December 31, 2001 the outstanding amount was $255M - the highest that it has ever been. It is something of a mystery why the company would borrow from the NIS at 17.08% per annum when it should be able to obtain a lower rate from the commercial banks. If it could not do so and all things being equal that could possibly suggest that the banks consider the company an above average credit risk which it might not have been prudent for the NIS to undertake.

An additional issue is whether the law gives the NIS the authority to make such loans. Section 33(5) of the NIS Act states “any monies forming part of the fund may from time to time be invested by the Board in such securities as may be approved by the Administration.” It is doubtful that an apparently unsecured loan falls within the definition of securities suggesting that the Board has no such authority.

During the year, the Scheme made its largest single investment in the form of a loan of US$4M to the Government of Guyana for the purpose of building the Caricom Secretariat Headquarters. The loan is repayable over 25 years at a rate of 4% in the first 15 years and 5% in the next ten years. Questions arising from this loan include a) whether it was negotiated at arm’s length; b) how the fixed rate compares with the rate of return assumed by the actuaries; and c) from a wider perspective whether the NIS is bearing part of the cost of hosting Caricom in Guyana.

Operational problems?

The Annual Report provides some very useful information on registration of employed and self-employed persons that raises concerns about the Scheme’s success in its mandate to register those persons and/or the spin which is put on the performance of the economy. Successive Reports show that the number of employed persons registering annually has declined from 10,712 persons in 1992 to 9,307 in 1997 and 6,915 to 2001. Nor does the Report not suggest that the large numbers leaving schools annually are moving into self-employment. The number of self-employed annual registrants rose quite dramatically from 1030 in 1992 to 1586 in 1996, but it has been downhill since then reaching its lowest level to date of a paltry 332 or 79% of the number registering in 1996. These figures which are corroborated by the cumulative numbers are both instructive and frightening, as they tell a story of unemployment which does not receive the recognition and attention it warrants.

Recently there has been a spate of letters in the press about the difficulties experienced by contributors, particularly those reaching pensionable age seeking to claim their benefits. Despite the long-standing and serious nature of this problem the Scheme has failed to resolve it or to convince the public that it is treating it with the urgency it deserves. For almost two decades I have advocated without success for the Scheme to confirm annual and cumulative contributions at the end of each year as is enshrined in the law in Grenada.

In the late ‘80s Dr Nanda Gopaul and I assisted the TUC in the preparation of a submission to the Government on the TUC. While there have been some amendments to the NIS laws since that time, there is no evidence that the authorities formally considered the TUC’s submission. And in 1993, the IDB submitted a Review and Analysis of the Scheme and made sweeping recommendations for its reform, but ten years after, very little has changed. Meanwhile, the TUC has been particularly silent on NIS matters despite their effect on the membership of the movement. Surely this is one area where the various factions in the movement could find common ground.

We noted last week the failure by the Board to implement the recommendations contained in the last Actuarial Report as at December 31, 1998. The 2001 Report gives no indication when the report on the next study due at December 31, 2003 would be available. BP strongly believes that the period for such studies should be reduced to three years and that the Scheme should retain its own firm of actuaries available to it on a continuous basis.

Conclusion

The NIS controls more assets than several of the commercial banks operating in Guyana. It needs to be managed with much greater recognition of the principles of good governance including more timely and informative financial information. Indeed, the Report’s commendable quality of statistical information is not matched by the quality of its financial statements for which the directors are responsible. However, there is nothing preventing the auditors from bringing their influence to bear on those statements with a view to improving their quality and rendering them more helpful to the Scheme’s stakeholders which include all the employers and employees in the country and those in receipt of pensions and other benefits.

The NIS is a good case of where form alone means nothing. It has a fairly manageable sized board of nine, including the Scheme’s CEO as deputy Chairman, a leading trade unionist, another who is a representative of the TUC, a leading member of the Private Sector Commission and the head of an accounting firm. Head of the Presidential Secretariat Dr Roger Luncheon has been the Scheme’s chairman since his Party won the 1992 elections. While at the operations level the Scheme has made considerable efforts to earn a reputation as a worker-friendly organization, it is time that the Board consider whether its structure and composition would not benefit from a major overhaul including changes at the top. Despite the huge accounting reserves, the viability of a long-term scheme is measured by its actuarial rather than its accounting liabilities. On that score, there must be serious concerns.