| Related Links: | Articles on Budget 2003 |

| Letters Menu | Archival Menu |

The main issues are:

1. Modernising the traditional sectors and promoting growth in non-traditional sectors

The Minister summarised the measures taken in 2002 and aimed for 2003 as follows:

Sugar: With all approvals for its expansion programme in place, Guysuco is now earmarked to receive support to access the approx. US$110Mn, needed for the Skeldon Expansion Project. The Minister announced that the Government would introduce a new management contract for the Corporation while a new cane payment system would be introduced for independent farmers.

Rice: The Minister again referred to the assistance package negotiated on behalf of those rice farmers who owe the commercial banks less than $10Mn; a possible agreement for those who owe more than $10Mn and who can prove that the money was invested in rice, securing financial assistance from the European Union for a comprehensive restructuring of the sector; and implementation of a National Action Plan over a 10 year period.

Bauxite: Initiatives announced included the merger of Aroaima and Bermine, the privatisation of Linmine and an agreement between Omai Gold Mines Limited and Linmine for stripping and mining.

Non-traditional: With the clearing of the country of the dreaded 'foot and mouth' disease, the Minister signalled aggressive moves to expand the beef industry including new veterinary health legislation. He also announced that the government would revamp the tax and incentives regimes for the manufacturing sector and bring the Guyana Tourism Authority into full operation with the principal task of marketing the country's eco-tourism resources.

Forestry, precious metals and oil: No initiatives.

2. Renewal and Expansion of Economic Infrastructure

The Minister highlighted a $900Mn programme for drainage and irrigation, a $1Bln project for other agriculture support and $1.1Bln to be spent on sea defence.

Resurfacing of the Mahaica/Rosignol Road, the construction of a 4-lane highway from the Harbour Bridge to Georgetown, construction of 59 bridges between Timehri and Rosignol and commencement of resurfacing of the runway and reconstruction of the incoming terminal at the CBJ Airport are the major plans for the Transport and Communication sectors.

The Minister announced hopes for the deregulation of the telecommunication sector and in respect of electricity services, plans for review of the energy policy and a project to connect 40,000 unserved electricity customers.

3. Improving the Financial, Institutional and Regulatory Environment

The Minister identified the following specific action to be taken:

(i) Completion of a report on the supervisory strategy of the Bank of Guyana leading to subsequent amendments of the Bank of Guyana and Financial Institutions Act;

(ii) Full implementation of the Money Laundering (Prevention) Act;

(iii) Introduction of an Industrial Development Authority Act and a Free Zone Act.

(iv) Promotion of fairer trading by enactment of Competition Commission, E-Commerce and Consumer Protection legislation

4. Accountability and Transparency

The measures announced were:

The procurement of a modern, fully computerised, off-the-shelf Integrated Financial Management and Accounting System to address the current inadequacies of the budget and accounting functions of the Government for full operations by 2004.

New Fiscal Management and Accountability Act and Audit Act along with the adoption of a new procedures manual and reorganisation plan for the Auditor General's Office. These initiatives were also planned in 2002.

Amendments to the Procurement and Tenders Act which was only recently enacted (during 2002).

Institution of reform of the Tax System including strengthening of the Income Tax Laws and review of the Customs and Guyana Revenue Authority Acts. The Minister announced that the Government would seek to enshrine the incentives regime into law and briefly noted that the Government would fill a number of critical positions within the GRA.

The Financial Stability Unit which was mentioned in the 2002 budget was not commented on in this budget.

Ram & McRae's Comments

The Minister was surely over-ambitious in suggesting that the Government could ensure Guysuco's profitability while his comments on the rice sector suggest that there is still an inadequate appreciation of the state of the sector and the number of businesses which are out of operation because the banks have given up all hopes for many of them.

While participation by Omai is likely to salvage the Demerara bauxite operations, there appears to be no realistic plan for the Berbice operations.

The lack of comments on the on/off-shore exploration for oil in Guyana is surprising given the current uncertainties in the regional and international oil market. In this connection, the Government must take better steps to improve relations with neighbours Venezuela and Suriname.

In his review of the international scene, the Minister acknowledged the war in Iraq and its possible impact on Guyana but did not identify any specific consequences for the country or any strategy to minimise those consequences.

A new draft Audit Act prepared by international consultants was to have been put into law by May 1, 2002 as part of an IMF conditionality. The Government however has shown little enthusiasm for a stronger Audit Office and has taken advantage of the inadequate functioning of the parliamentary committees to delay its implementation. Focus has always advocated enhancing the independence of the Auditor General's Office, but with so many broken promises, is now to be convinced that this time the Government means what it says and that in future, it will act promptly on the findings of the Auditor General.

We consider the steps to improve the regulatory financial environment far too ambitious and that instead of placing more responsibility on the Central Bank, a separate Financial Services Authority should be set up allowing the Bank to revert to its core responsibility for monetary management.

The Government has not been keen on various attempts to limit the number of tax remissions which narrow the tax base, reduce the scope for the overall lowering of the tax rates and possible opportunities for higher collections. It is not clear which incentives regime the Minister was referring to but such regimes must be considered against the state of the economy and the mantra of the IMF which has wide influence over the country's economic programmes. On Budget day the IMF coincidentally issued a Public Information Notice on the Currency Union of the Eastern Caribbean which criticised the level of tax exemptions and discretionary concessions in that region.

There was inadequate attention paid to the Guyana Revenue Authority on which so much store was placed prior to its establishment. The Authority has been without a head for close to nine months and with no deputy, the Authority cannot function effectively. While the Minister speaks of filling critical vacancies, he needs to ponder the state of the GRA without a Commissioner General and its fate if the head of one or both of the departments resigned. The Minister would not be unaware that the resignation of the former Commissioner General came amidst criticisms of internal corruption in the GRA and the conclusions the public might draw from his failure to address in a more decisive manner the problems of the country's principal revenue agency.

No mention is made of Copyright legislation the lack of which has crippled the cinema industry and would likely lead to the same fate of our young artists.

As though coincidences were against him, the press reported on the collapse of the negotiations with Guyana Power and Light while the Minister is reporting plans for 40,000 new connections.

THE GOVERNMENT OF GUYANA

FINANCIAL PLAN 2003

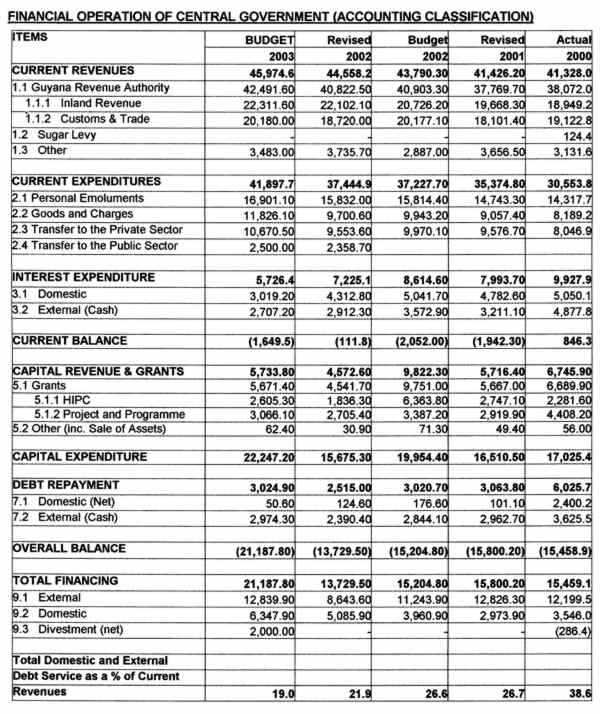

The table on page 19 presents a summary of the Government's projected financial plan for 2003. Some of the 2002 figures, which appeared in the 2002 Estimates, have been restated in the 2003 Estimates without any explanation. The Plan projects a negative current balance of G$1.65Bn after taking interest and current expenditure from current revenue, compared with a negative balance of G$111.8Mn in the 2002. This is a major turnaround from a budgeted deficit of G$2.05Bn in 2002. The principal elements of the 2003 Plan are:

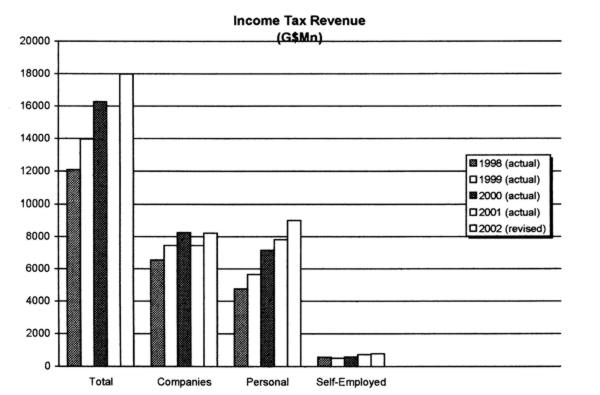

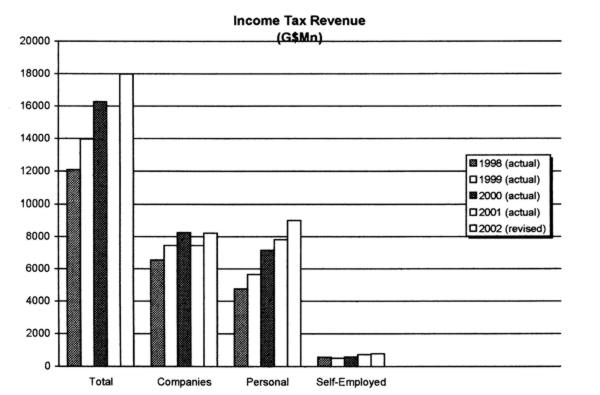

Current revenues are projected to increase to G$45.98Bn in 2003 from G$44.56Bn in 2002. The Revenue Authority projects an increase of G$1.67Bn or 4% over 2002 and now hopes to bring in 92.4% of the total current revenue. In 2002, the Revenue Authority realised an increase in its revenues of 8% over the previous year but fell short of budget by G$80Mn. Collections in 2002 over 2001 of the Internal Revenue Department increased by G$2,433Mn or 12.37% and accounted for 54% as compared to 52% of Guyana Revenue Authority's revenue.

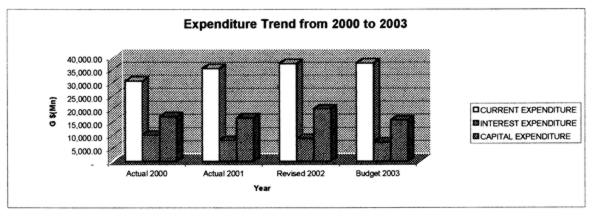

Total Current expenditure is projected to increase by 6.6% from G$44.67Bn to G$47.62Bn in 2003. It is made up of interest expenditure of G$5.7Bn (2002-G$7.23Bn), personal emoluments of G$16.901Bn or 35% (2002- 35%) and other charges of G$24.997Bn (2002- G$21.612Bn). The main allocations of the non-interest expenditure were the Ministry of Finance 15%, Ministry of Education 9%, Ministry of Home Affairs 8%, Guyana Defence Force 6% and Ministry of Health 5%.

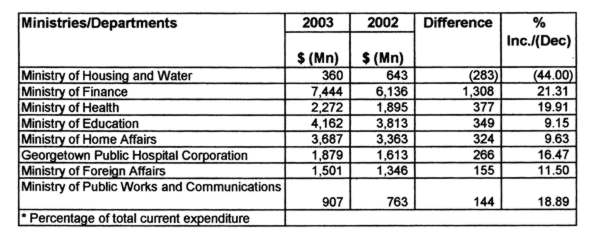

There are several significant projected changes in the allocation of certain expenditure in comparison to 2002. Major decreases over 2002 include: Ministry of Housing and Water 44% and Office of the Prime Minister 4%.

Significant projected increases over 2002 include: Ministry of Finance 21%, Public & Police Service Commission 45%, Teaching Service Commission 53%, Ministry of Health 20%, Georgetown Public Hospital Corporation 16%, Public Prosecutions and Public Service Appellate Tribunal 21.11%.

Total interest expenditure is projected to decrease by 21% from G$7.225Bn in 2002 to G$5.726Bn in 2003 or approximately 12.46% of current revenue compared with 16.2% in 2002. Interest on domestic and external debts is projected to decrease by 30% and 7% respectively.

Capital revenue is projected at G$5.733Bn (2002-G$4.573Bn) and capital expenditure at G$22.247Bn (2002-G$15.675Bn). The revenue figure is made up principally of HIPC grants ($2.605Bn) and Project and Programme funds ($3.066Bn).

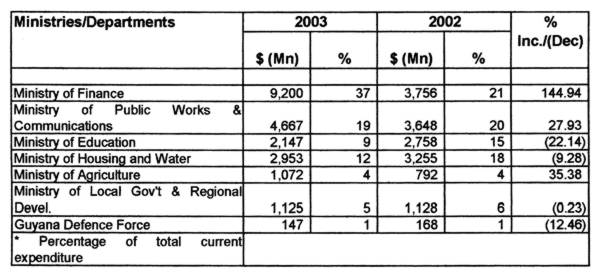

Capital expenditure of G$22.247Bn represents a 41.93% increase over 2002. This follows a decline in 2002 and 2001 of 5% and 3% respectively. The proposed allocation of the capital expenditure includes: Ministry of Finance 37%, Ministry of Agriculture 4%, Ministry of Public Works and Communications 19%, Ministry of Education 9%, Ministry of Housing and Water 12%, and Ministry of Local and Regional Government.

Debt repayment is projected at G$3.025Bn (2002-G$2.515Bn) made up of domestic debt repayments of G$50.6Mn and external debt repayments of G$2.974Bn, representing a decrease of 59.4% and increase of 24.4% respectively over the previous year. There is an overall deficit of G$21.189Bn compared with a deficit of G$13.730Bn in 2002. It is projected that the deficit will be financed from domestic and external sources of G$9.347Bn and G$12.84Bn respectively. The overall balance of deficit before grants is projected at G$26.859Bn which is G$8.588Bn more than the deficit of G$18.271Bn in 2002 before grants.

During 2003, Domestic and External Debt Service as a percentage of current revenue is projected at 19% compared with a revised budget for 22% in 2002 and 27% for the preceding year.

Ram and McRae's Comments

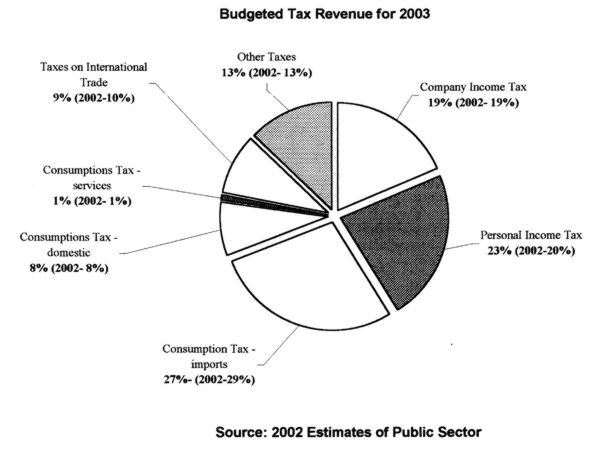

The composition of projected revenue for 2003 is essentially the same as 2002. The contribution by Personal Income Tax increased slightly in 2003 [23%] compared with 2002 [20%].

WHO GETS WHAT IN 2003

Current Non-Interest Expenditure

In this section we consider how the budgeted expenditure is allocated among competing Ministries, Departments, Programmes and Projects.

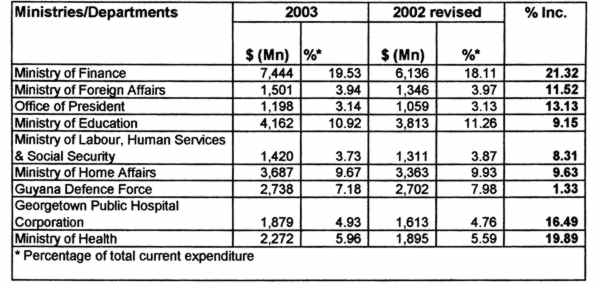

Central Government's non-interest current expenditure (employment costs and other charges) for the year is budgeted at G$38.119Bn which is 13% more than revised 2002. The Ministries/ Departments with the most significant allocations are:

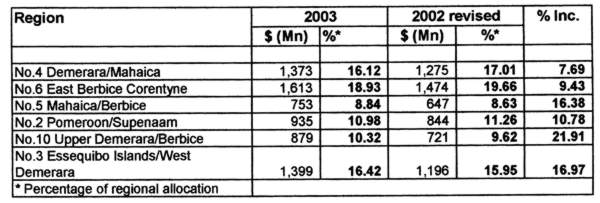

As in the previous year, the Ministry of Finance, Ministry of Education, Ministry of Home Affairs and Guyana Defence Force receive the most significant allocations. Separate allocations are provided for the Ministry of Foreign Trade and International Cooperation and the Ministry of Amerindian Affairs. The regions with the most significant allocations are:

Significant changes from the previous year's latest estimates occurred in the following Ministries/ Departments:

The main Ministry where budgetary allocation decreased over 2002, was the Ministry of Housing and Water ($283Mn). The main increases in the allocations are as follows: The Ministry of Finance $1,308Mn, Ministry of Health $377Mn, Ministry of Education $349Mn, Ministry of Home Affairs $324Mn, Georgetown Public Hospital Corporation $266Mn, Ministry of Foreign Affairs $155Mn, Ministry of Public Works and Communications $144Mn.

Capital Expenditure

Central Government's capital expenditure for the year is budgeted at G$24.75Bn which is 37% above revised 2002 and 39% of total 2003 expenditure. The Ministries/ Departments with the most significant capital expenditure allocations are:

The substantial increase in the capital budget for the Ministry of Finance is accounted for by the onlending to GUYSUCO ($5,412 Bn) and loan to Linmine ($2,500Bn).

Regional Allocations

Region 6 (East Berbice/Corentyne) whose share of the country's population is about 20%, received approximately 18.6% of the total current expenditure amount allocated to the regions. The situation regarding the total expenditure allocation is similar. Region 6 gets 19% while the even smaller Region 3 (Essequibo Islands/West Demerara), with a population share of 12.5% gets 16% of the amount of the regional expenditure, which compares to a similar amount in 2002. On the other hand, Region 4, with 42% of the country's population receives only 15.2% of the total expenditure allocated to the regions.

Ram & McRae's Comments

These percentages remain largely unchanged from the previous year. Region 4 has the greatest unfavourable disconnect between population and expenditure while Region 6 receives an allocation that is almost commensurate with its population.

2003 Budget Measures

1. Increase of the income tax threshold from $216,000 to $240,000 per annum.

Comment: In nominal terms, the increase of $2,000 per month equates to an 11.1% increase. However, when related to purchasing power at rates of exchange at the relevant dates a different picture emerges. $18,000 in 1997 was worth US$125 while $20,000 in 2003 is worth US$104, equivalent to a decline of 16.8%.

2.10% consumption tax on all domestic telephone calls effective April 01, 2003

Comment: Prior to this, consumption tax only applied to overseas telephone calls.

3.Introduce Value Added Tax (VAT) by 2006

Comment: While this is the first time that a firm date is set, the Minister did not indicate whether there is an operational plan or any road map to achieve this ambitious target. It would be extremely unusual and even dangerous to introduce a major, complicated tax in what is scheduled to be an election year.

4.Increased in withholding tax from 15% to 20% on interest income and from 10% to 20% on payments other than interest to non-residents.

Comment: This will reduce the relative advantage which savings enjoy over other forms of income. Persons who rely entirely on saving will lose while lenders may raise interest rates to make up for the reduction of post-tax income.

COMMENTARY AND ANALYSIS

Guyana ranks among the poorest countries in the Western Hemisphere in company with Haiti and Nicaragua. The Poverty Reduction Strategy had as its focus the reduction of poverty in the context of accelerated economic growth and improved social conditions. Average GDP for the five-year programme was projected at 4% p.a. That modest goal is now clearly unattainable but the implications of shortfalls are not sufficiently addressed if at all in the PRSP. While the political climate has had some impact on economic performance it seems that the greater problem and causes lie in the failure to take the required action within the timelines set. Missed targets include establishing the office for a Stock Exchange by July 2000, enforcement of compliance with local consumption tax in 2001 and enhancing the efficiency of delivery of Public Sector Services with a Technical Assistance component in September 2000.

The execution capabilities and managerial expertise of both the Cabinet and the public service fall short of the standards required to bring about accelerated economic growth. Without significant improvements in these areas, Guyana will continue to languish among the poorest in the region

Corruption

Not once was the word corruption mentioned in the fifty-one pages of the Minister's Speech. The annual reports of the Auditor General continue to highlight numerous cases of corruption while in the capital programme, it is believed that a not insignificant percentage is lost through weak tendering procedures, substandard work and corruption. The Minister cannot not understand the reasons behind the insistence by the IFI's for disclosure of public officials' assets, reform of the tendering procedures and transparency in the tax system.

In addition to the measures outlined above, a fully equipped, effective and independent Auditor General is a measure which can act both as a deterrent as well as a control for identifying at early stages opportunities for and actual cases of fraud and corruption.

The Revenue Authority

Despite being in operation for more than two years, the Authority is yet to publish an Annual Report. It is currently headless. It receives considerable sums by way of subvention including a 43% increase budgeted for 2003. It must provide an adequate return on those funds. It has the mandate and the duty to enforce the tax laws against anyone and everyone. It knows who the tax dodgers are and carries in its hands the not inconsiderable weight of the law. In doing its job, it must allow no one to stand in its way - even if it leads to the jail.

The parallel economy

Recent studies and information suggest that the underground economy is quite substantial, perhaps as high as 30% of GDP. Focus has made some rough calculations of the illicit trade in fuel alone and the numbers are frightening. There is also the growing importance of remittances from non-resident Guyanese which according to recent estimates amount to approximately 15% of GDP. These phenomena suggest a huge hole in the economy over which control is very difficult. They pose both challenges and opportunities but they do not lend themselves to conventional approaches. It is important that the Government seek to determine the scale of these activities as a first step to facilitating their contribution to the economy.

Governance

The success of a budget is always dependent on the success of the private sector. Public confidence in the reporting practices of this sector is sadly low internationally. Good governance practices are needed in our major private and public corporations as much as it is needed within the Government.

Reforms in the United States include the Sarbanes-Oxley Act and new listing requirements of the New York Stock Exchange. Such reforms will no doubt need to be remodeled to suit Guyana's needs through the recently established Guyana Securities Council to ensure that the level of public confidence in our private sector is high. The operationalising of the Securities Council has been a positive development in 2002 while the Institute of Chartered Accountants of Guyana is now more committed to ensuring that accounting standards it adopts are applied consistently.

The application of better corporate governance will inspire confidence in the private sector and add authority to its voice on national issues.

Conclusion

Even if the Minister did not have the considerable political divisions in the country to contend with, the state of the economy requires strong, imaginative and focused management to turn it around. It is difficult to see how the measures identified in the Speech will lead to achieving the goals identified by the Minister. Where are the policies to attract investments and why does the Minister tell us about the level of unemployment internationally but not locally? Why is he not prepared to meaningfully widen the tax net and reduce discretionary waivers and exemptions? Had he done so he would have been able to respond far more favourably to the workers' anguished call for relief.

The challenge is indeed formidable but the Minister needs to show more confidence in his own ability and those of his team. He needs to understand the challenges of labour and the private sector with which he can and should have meaningful dialogue. Rebuilding the economy will require not only teamwork but partnerships as well. Combining with these two groups could go a long way to meeting the challenge.

Speech Highlights

2002 Facts

Real Growth in the economy of 1.1% compared to a target of 2% and actual of 1.9% in 2001

Overall balance of payments deficit increased from US$8.4Mnin 2001 to US$25.1Mn

Overall expansion of the monetary base by 10% to $36.3 billion

Inflation rate of 6.1% as compar4ed to target of 5%

Depreciation of the Guyana Dollar by 1.2% compared to 2.6% in 2001

Increase in Current Revenue collections from G$41.4Bn in 2001 to GS44.6Bn

Current account deficit of US$106.7Mn and net inflows on the capital account of US$88.7Mn (2001 - US$115.3)

Minimum public sector wage increased by 5% to $21,047 per month

Increase in sugar production of 16.4% and decreases in rice of 10.7% & bauxite of 18.9%

Export of US$494.9Mn compared to imports of US$563.1; a trade imbalance of $68.2Mn

Measures - 2003

Increase in withholding tax rates from 15% and 10% to 20%

Introduction of a 10% consumption tax on all local telephone calls including cellular calls

$1.9Bn of external finance for drainage and irrigation, $533Mn for sea defence

commencement of construction of a four-lane highway from the Harbour Bridge to the city, resurfacing the Mahaica/Rosignol road and parts of Mandela Avenue

$7.2Bln for national security

Implementation of tax reform following an assessment completed in 2002

$895Mn + for poverty reduction with an additional $5.7 billion over the next 5 years

Financial Targets - 2003

Inflation of 5% with growth in Real GDP of 1.2%

Increase of 45% in the current account deficit to US$154.3Mn

Current expenditure of $49,9Bn, an increase of 3.5% over 2002

Current revenue of $46Bn, a 3.2% increase over 2002

Estimated total expenditure of $72.9Bn, 15.9% more than in 2002

Overall deficit of non-financial sector to increase by 123% from $7.4Bn to $16.5Bn (11.5% of GDP)

Increase of 55% in the overall deficit after grants from $13.7Bn to $21.2Bn or 15% of GDP

Overall deficit of the central government (before grants) to increase by 46% to $26.8Bn